(Cash flow) Jeri Jackson, the controller of Nevada Gaming Systems Inc., has become increasingly disillusioned with the...

Question:

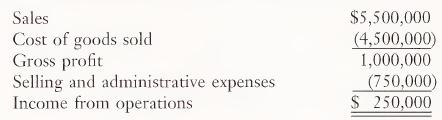

(Cash flow) Jeri Jackson, the controller of Nevada Gaming Systems Inc., has become increasingly disillusioned with the company’s system of evaluating the performance of profit centers and their managers. The present system focuses on a comparison of budgeted to actual income from operations. Ms. Jackson’s major concern with the current system is the ease with which the measure “in¬ come from operations” can be manipulated by profit center managers. The “ba¬ sic business” of Nevada Gaming Systems is the design and production of slot machines and other gaming devices. Most sales are made on credit and most purchases are made on account. The profit centers are organized according to product line. Below is a typical quarterly income statement for a profit center, Slot Machines, that appears in the responsibility report for the profit center:

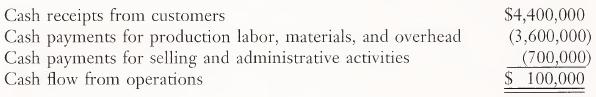

Ms. Jackson has suggested to top management that the company replace the accrual income evaluation measure, “income from operations,” with a measure called “cash flow from operations.” Ms. Jackson suggests that this measure will be less susceptible to manipulation by profit center managers. To defend her position, she compiles a cash flow income statement for the same profit center:

a. If Ms. Jackson is correct about profit center managers manipulating the in¬ come measure, where are manipulations likely taking place?

b. Is the proposed cash flow measure less subject to manipulation than the income measure?

c. Could manipulation be reduced if both the cash flow and income measures were utilized? Explain.

d. Do the cash and income measures reveal different information about profit center performance?

e. Could the existing income statement be used more effectively in evaluating performance? Explain.

Step by Step Answer: