(Computing ratios, LO 2) Hurstwood Wineries Ltd. (Hurstwood) produces and markets wines from a number of wineries...

Question:

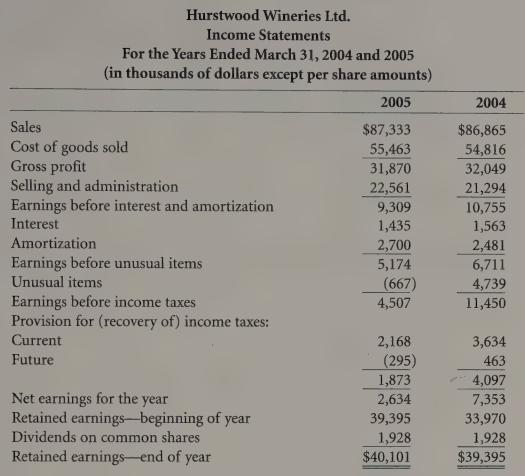

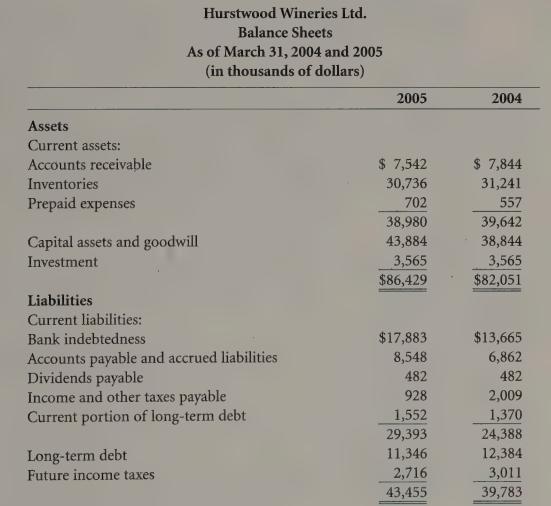

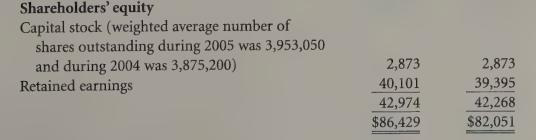

(Computing ratios, LO 2) Hurstwood Wineries Ltd. (Hurstwood) produces and markets wines from a number of wineries across Canada. You have been provided with the following income statements and balance sheets for Hurstwood:

Required:

a. Compute the following ratios and amounts for Hurstwood for 2005 and 2004:

i. gross margin ii. gross margin percentage ili. profit margin iv. profit margin percentage v. earnings per share vi. working capital vii. current ratio viii. quick ratio ix. debt-to-equity ratio x. interest coverage ratio xi. dividend payout ratio

b. Compute the following ratios and amounts for Hurstwood for 2005:

i. asset turnover ii. financial leverage iii. return on equity iv. return on assets v. inventory turnover ratio vi. average number of days inventory on hand vii. accounts receivable turnover ratio viii. average collection period of accounts receivable ix. accounts payable turnover ratio xX. average payment period for accounts payable xi. cash lag

c. How do the unusual items reported on the 2004 and 2005 income statements affect your ability to predict Hurstwood’s future performance?

d. Comment on Hurstwood’s liquidity, based on amounts you calculated in parts

(a) and (b). Be sure to consider the nature of Hurstwood’s business in your response.

Step by Step Answer: