(Examining the effect of debt covenants on debt and dividends) During fiscal 2005, Husavick Inc. (Husavick) borrowed...

Question:

(Examining the effect of debt covenants on debt and dividends) During fiscal 2005, Husavick Inc. (Husavick) borrowed $500,000 from a private lender. The loan agreement requires that Husavick’s debt-to-equity ratio not exceed 2:1 at any time.

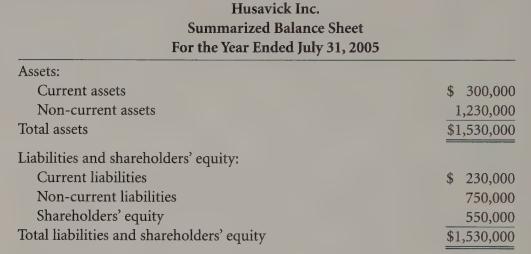

You have been provided with the following information from Husavick’s accounting records:

Required:

a. Calculate Husavick’s debt-to-equity ratio on July 31, 2005.

b. How much additional debt could Husavick have borrowed without violating the debt covenant?

c. How much could Husavick have paid in dividends during fiscal 2005 without violating the debt covenant?

d. Suppose that on December 15, 2005 Husavick’s board of directors declared a dividend of $125,000. The dividend is to be paid on January 15, 2006. What would the impact of this event be on the financial statements and on the debt covenant on December 31, 2005?

Step by Step Answer: