Dunsinane Ltd. (Dunsinane) is a publicly traded manufacturing company that makes computer components for sale to end-product

Question:

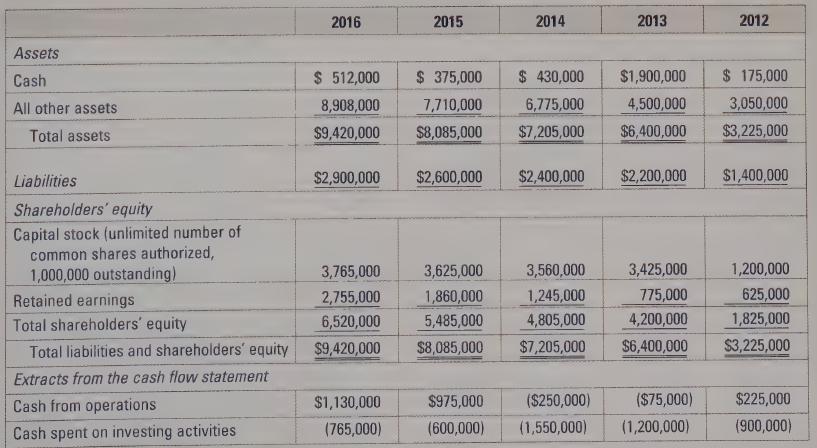

Dunsinane Ltd. (Dunsinane) is a publicly traded manufacturing company that makes computer components for sale to end-product manufacturers. Extracts from the last five years’ financial statements are shown below.

Dunsinane completed an expansion in 2014 that was financed by a share issuance made in late 2013. Management believes that cash from operations should now be fairly stable and the net cash outflows on investing activities should range between

\($900,000\) and \($1,500,000\) per year. To date, Dunsinane has not faced the effects of any economic slowdowns. There is concern of the effects of a prolonged slowdown on Dunsinane’s revenues, income, and cash flow. Dunsinane has access to a \($1,000,000\) line of credit secured against accounts receivable that it hasn’t used to date. After two years of satisfactory and steady performance since the expansion was completed, the board of directors is considering a proposal to implement an annual common share dividend. Dunsinane has never paid dividends before.

Required:

Prepare a report to Dunsinane’s board of directors, assessing the pros and cons of implementing an annual common share dividend. Identify additional information needed to make a definitive decision. If you recommend that a dividend should be paid, what amount per share should be paid? Provide support for your positions.

Step by Step Answer: