(Lease accounting and financial ratios, LO 5,9) Zeballos Inc. (Zeballos) is planning to lease new equipment for...

Question:

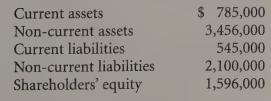

(Lease accounting and financial ratios, LO 5,9) Zeballos Inc. (Zeballos) is planning to lease new equipment for its distribution centre. The terms that Zeballos has agreed to require that it pay $250,000 per year for the next five years. The interest rate for the lease is 8%. Zeballos has provided you with the following balance sheet information before the new lease has been accounted for:

Required:

a. Calculate the current ratio and debt-to-equity ratio for Zeballos, assuming the lease is accounted for as an operating lease.

b. Calculate the current ratio and debt-to-equity ratio for Zeballos, assuming the lease is accounted for as a capital lease.

c. Which calculations provide a better representation of Zeballos’ liquidity and underlying risk? Explain.

d. Does it matter how Zeballos accounts for its lease (GAAP. notwithstanding)?

Explain.

Step by Step Answer: