On October 31, 2014, Pahonan Inc. (Pahonan) purchased 75 percent of the common shares of Seebe Ltd.

Question:

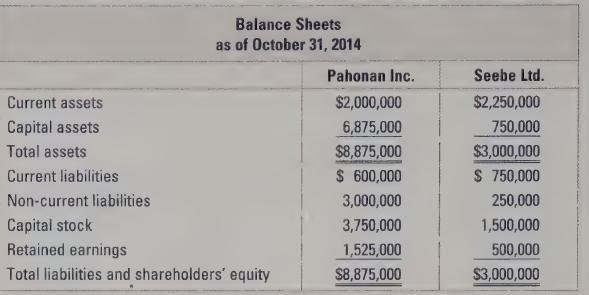

On October 31, 2014, Pahonan Inc. (Pahonan) purchased 75 percent of the common shares of Seebe Ltd. (Seebe) for \($1,500,000\). Pahonan’s and Seebe’s balance sheets on October 31, 2014, just before the purchase are shown:

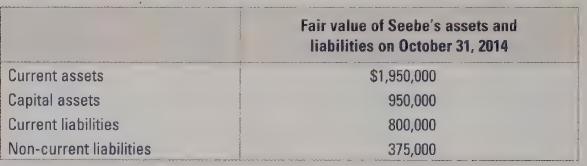

Management determined that the fair values of Seebe’s assets and liabilities were as follows:

Required:

a. Prepare the journal entry that Pahonan would make to record its purchase of Seebe’s shares.

b. Prepare the journal entry that Seebe would make to record its purchase by Pahonan.

c. Calculate the amount of goodwill to be reported on Pahonan’s consolidated balance sheet on October 31, 2014.

d. Calculate the amount of non-controlling interest to be reported on the consolidated balance sheet on October 31, 2014.

e. Prepare Pahonan’s consolidated balance sheet on October 31, 2014.

f. Calculate the current ratios and debt-to-equity ratios for Pahonan and Seebe, and for the consolidated balance sheet on October 31, 2014. Interpret the differences between the ratios.

g. Explain what the non-controlling interest on the balance sheet represents. How would you interpret it from the perspective of a shareholder of Pahonan? How would you interpret it from the perspective of a shareholder in Seebe? How would you interpret it from the perspective of a lender?

Step by Step Answer: