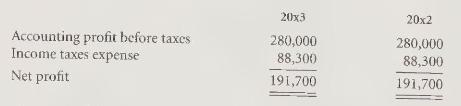

The Delcampo Corporation reported the following accounting profit before income taxes, income taxes expense, and net profit

Question:

The Delcampo Corporation reported the following accounting profit before income taxes, income taxes expense, and net profit for \(20 \times 2\) and \(20 \times 3\) :

Also, on the balance sheet, deferred income taxes liability increased by 38,400 in \(20 \times 2\) and decreased by 18,800 in \(20 \times 3\).

1. How much did Delcampo Corporation actually pay in income taxes for \(20 \times 2\) and \(20 \times 3\) ?

2. Prepare journal entries to record income taxes expense for \(20 \times 2\) and \(20 \times 3\).

LO 4 Earnings per Share

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Financial Accounting A Global Approach

ISBN: 9780395839867

1st Edition

Authors: Sidney J. Gray, Belverd E. Needles

Question Posted: