The management of Tumatoe Inc. asks your help in determining the comparative effects of the FIFO and

Question:

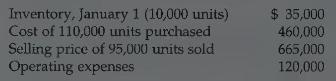

The management of Tumatoe Inc. asks your help in determining the comparative effects of the FIFO and LIFO inventory cost flow methods. For 1998, the accounting records show the following data:

Units purchased consisted of 40,000 units at \(\$ 4.00\) on May \(10 ; 50,000\) units at \(\$ 4.20\) on August 15 ; and 20,000 units at \(\$ 4.50\) on November 20. Income taxes are \(30 \%\).

\section*{Instructions}

(a) Prepare comparative condensed income statements for 1998 under FIFO and LIFO. (Show computations of ending inventory.)

(b) Answer the following questions for management in the form of a business letter:

(1) Which inventory cost flow method produces the most meaningful inventory amount for the balance sheet? Why?

(2) Which inventory cost flow method produces the most meaningful net income? Why?

(3) Which inventory cost flow method is most likely to approximate actual physical flow of the goods? Why?

(4) How much additional cash will be available for management under LIFO than under FIFO? Why?

(5) How much of the gross profit under FIFO is illusionary in comparison with the gross profit under LIFO?

Step by Step Answer:

Financial Accounting

ISBN: 9780471169208

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso