(Transfer prices; discussion) Better Products Inc. is a decentralized company. Each division has its own sales force...

Question:

(Transfer prices; discussion) Better Products Inc. is a decentralized company. Each division has its own sales force and production facilities and is operated as an investment center. Top management uses return on investment (ROI) for per¬ formance evaluation. The Hazlett Division has just been awarded a contract for a product that uses a component manufactured by the Andalusia Division as well as by outside suppliers. Elazlett used a cost figure of $3.80 for the component when the bid was prepared for the new product. This cost figure was supplied by Andalusia in response to Hazlett’s request for the average variable cost of the component.

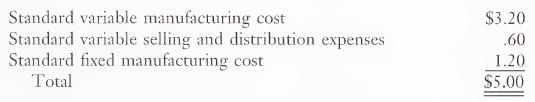

Andalusia has an active sales force that is continually soliciting new custom¬ ers. Andalusia’s regular selling price for the component Hazlett needs for the new product is $6.50. Sales of the component are expected to increase. Andalusia management has the following costs associated with the component:

The two divisions have been unable to agree on a transfer price for the component. Corporate management has never established a transfer price be¬ cause interdivisional transactions have never occurred. The following suggestions have been made for the transfer price:

* Regular selling price ■ Regular selling price less variable selling and distribution expenses m Standard manufacturing cost plus 15 percent ■ Standard variable manufacturing cost plus 20 percent

a. Compute each of the suggested transfer prices.

b. Discuss the effect each of the transfer prices might have on the Andalusia Division management’s attitude toward intracompany business.

c. Is the negotiation of a price between the Hazlett and Andalusia Divisions a satisfactory method to solve the transfer price problem? Explain your answer.

d. Should the corporate management of Better Products Inc. become involved in this transfer controversy? Explain your answer.

(CMA adapted)

Step by Step Answer: