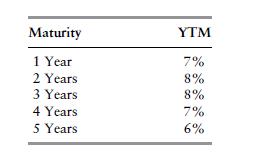

Assume the following yield curve for zero-coupon bonds with a face value of $100 and annualized compounding:

Question:

Assume the following yield curve for zero-coupon bonds with a face value of

$100 and annualized compounding:

a. Using implied forward rates, estimate the yield curve one year from the present (rates on one-year, two-year, three-year, and four-year bonds).

b. Using implied forward rates, estimate the yield curve two years from the present (rates on one-year, two-year, and three-year bonds).

c. If you bought the three-year bond and held it one year, what would your expected rate of return be if your expectations were based on implied forward rates?

d. Without calculating, if you bought a bond of any maturity and held it one year, what would your expected rate of return be if your expectations were based on implied forward rates?

e. If you bought the four-year bond and held it two years, what would your expected rate of return be if your expectations were based on implied forward rates?

f. Without calculating, if you bought a bond of any maturity and held it two years, what would your expected rate of return be if your expectations were based on implied forward rates?

Step by Step Answer: