Let (R, P) be the value of a European receiver, payer swaption with the same expiry, swap

Question:

Let \(R, P\) be the value of a European receiver, payer swaption with the same expiry, swap term, and strike \(K\).

(a) Let \(S\) be the value to the receiver of the underlying swap with fixed rate \(K\). Prove put-call parity for European-style swaptions: \(R-P=S\).

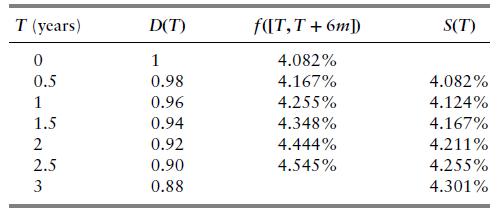

(b) Using Table 7.3, calculate the value to the fixed-rate receiver of a \$1M 1 year into 2-year forward swap with semiannual fixed rate of \(4 \%\) per annum.

(c) Using the results of Example 3, show that put-call parity holds.

Table 7.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Mathematical Techniques In Finance An Introduction Wiley Finance

ISBN: 9781119838401

1st Edition

Authors: Amir Sadr

Question Posted: