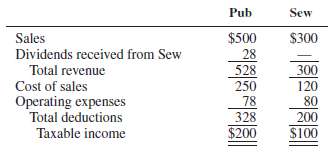

Taxable incomes for Pub Corporation and Sew Corporation, its 70 percent-owned subsidiary, for 2011 are as follows

Question:

Taxable incomes for Pub Corporation and Sew Corporation, its 70 percent-owned subsidiary, for

2011 are as follows (in thousands):

ADDITIONAL INFORMATION1. Pub acquired its interest in Sew at a fair value equal to book value on December 31, 2010.2. Sew paid dividends of $40,000 in 2011.3. Pub sold $90,000 in merchandise to Sew during 2011, and there was $10,000 in unrealized profit from the sales at year end.4. A flat 34% income tax rate is applicable.5. Pub is eligible for the 80% dividends-received deduction.REQUIRED:Prepare a consolidation income statement workpaper for Pub Corporation and Subsidiary for 2011.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith

Question Posted: