Go back

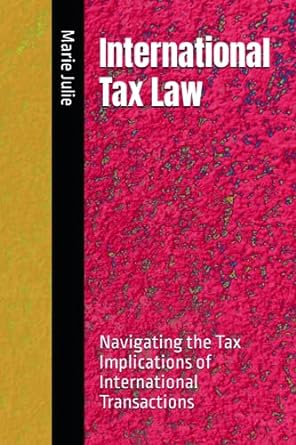

International Tax Law Navigating The Tax Implications Of International Transactions(1st Edition)

Authors:

Marie Julie

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $12.99

Savings: $12.99(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for International Tax Law Navigating The Tax Implications Of International Transactions

Price:

$9.99

/month

Book details

ISBN: 979-8856066158

Book publisher: Independently Published

Get your hands on the best-selling book International Tax Law Navigating The Tax Implications Of International Transactions 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: International taxation is a complex and dynamic field that deals with the taxation of cross-border transactions and the implications of conducting business across different jurisdictions. As the world becomes increasingly interconnected through globalization, businesses and individuals engage in international transactions more frequently, leading to intricate tax challenges and opportunities. This chapter serves as a foundational guide to understanding the basics of international taxation, exploring key concepts, terminologies, and the importance of international tax planning. It delves into the impact of globalization on taxation and the benefits and challenges that arise when navigating the tax implications of international transactions. Additionally, an overview of double taxation treaties is presented, highlighting their role in mitigating double taxation and promoting international cooperation in tax matters. By gaining insights into the fundamentals of international taxation, readers will be better equipped to comprehend the complexities of the global tax landscape and strategize effectively to optimize their tax positions in international dealings.In this section, we delve into the fundamental principles and concepts that underpin international taxation, providing readers with a comprehensive understanding of this intricate area of taxation. International taxation deals with the tax implications arising from transactions involving multiple countries or jurisdictions. As businesses expand globally and individuals engage in cross-border activities, navigating the complexities of international tax laws becomes crucial to ensure compliance and optimize tax efficiency. This chapter introduces readers to key aspects of international taxation, such as tax residency rules for individuals and businesses, and the concept of permanent establishment (PE). We explore the significance of determining tax residency and its impact on tax liabilities, as well as the strategies to avoid dual tax residency. Additionally, the chapter sheds light on the role of double taxation treaties in resolving conflicts and preventing double taxation. By comprehending the basics of international taxation, readers can lay a solid foundation for tackling the challenges and opportunities presented by the global nature of modern economic activities.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request 636lt32

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."

William T

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."