Go back

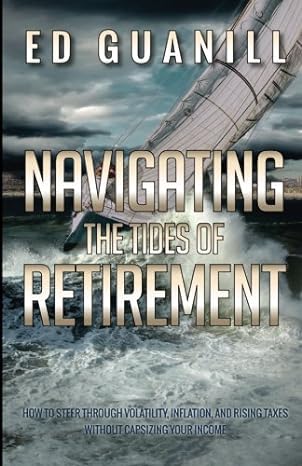

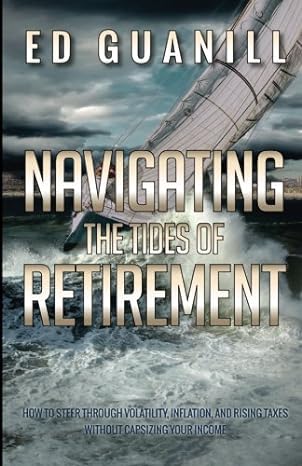

Navigating The Tides Of Retirement How To Steer Through Volatility Inflation And Rising Taxes Without Capsizing Your Income(1st Edition)

Authors:

Ed Guanill

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $12.95

Savings: $12.95(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Navigating The Tides Of Retirement How To Steer Through Volatility Inflation And Rising Taxes Without Capsizing Your Income

Price:

$9.99

/month

Book details

ISBN: 1533131953, 978-1533131959

Book publisher: CreateSpace Independent Publishing Platform (May 26, 2016)

Get your hands on the best-selling book Navigating The Tides Of Retirement How To Steer Through Volatility Inflation And Rising Taxes Without Capsizing Your Income 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Money represents more than the paper it’s printed on. It may be the embodiment of your time, your talents, and your commitments. It buys the food you eat, the house you sleep in, the car you drive, and the clothes you wear. It also helps provide you with the lifestyle you want to live once you retire. You have spent a lifetime earning it, spending it, and hopefully, accumulating it. When the time comes for retirement, you want your money to provide you with a comfortable lifestyle and stable income after your working days are done. You might also have other desires, such as traveling, purchasing property, or moving to be closer to your family (or farther away). You may also want your assets to provide for your loved ones after you are gone. The truth is that it takes more than just money to fulfill those needs and desires. Your income, your plans for retirement, your future healthcare expenses, and the continued accumulation of your assets after you stop working and drawing a paycheck all rely on one thing: You.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Pamela Beckford

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."