Go back

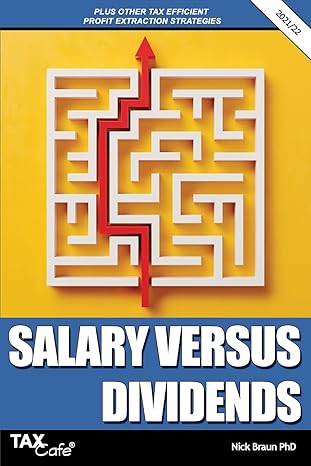

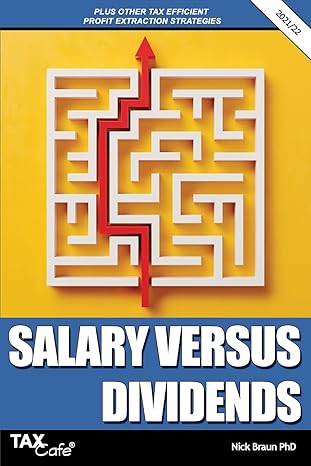

Salary Versus Dividends Plus Other Tax Efficient Profit Extraction Strategies(2022 Edition)

Authors:

Nick Braun

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $39.95

Savings: $39.95(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Salary Versus Dividends Plus Other Tax Efficient Profit Extraction Strategies

Price:

$9.99

/month

Book details

ISBN: 191102065X, 978-1911020653

Book publisher: Taxcafe UK Ltd

Get your hands on the best-selling book Salary Versus Dividends Plus Other Tax Efficient Profit Extraction Strategies 2022 Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Publication date: June 2021 - Plain English guide with dozens of examples and tax planning tips.Now in its 22nd edition, Salary versus Dividends is essential reading for ALL company owners and directors.It tells you everything you need to know about paying yourself the most tax efficient mix of salary and dividends.This year's edition contains full details of the corporation tax increase and the new company tax rules announced in the March 2021 Budget. We explain how these new rules will affect your tax planning.The guide also contains fully updated information on the best alternative profit extraction techniques: Directors loans - how they can be used to defer tax for an extra two years and sometimes to avoid tax altogether.Pension contributions - Why company pension contributions are better than dividends. And why you should consider postponing them.Rental income - Why rent is now better than dividends in many cases.Interest income - How company owners can pay themselves up to £6,000 tax-free.Cars and motoring costs - a Plain English guide to the tax rules.Charity - Who should donate: you or the company?Capital Gains - How to pay 10% tax when you sell or wind up your company; How to pay 0% tax when you sell your company to an employee ownership trust.These alternative techniques will become a lot more attractive when corporation tax increases.There's also information on splitting income with your spouse and children and other tax saving strategies.

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Cynthia Pritchard

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."