Go back

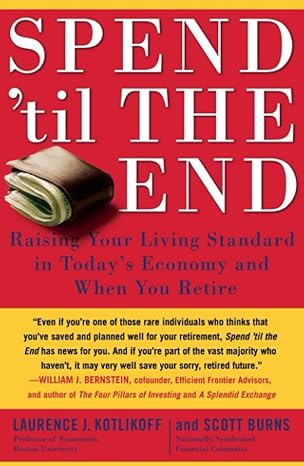

Spend Til The End Raising Your Living Standard In Todays Economy And When You Retire(1st Edition)

Authors:

Laurence J. Kotlikoff, Scott Burns

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $23.80

Savings: $23.8(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Spend Til The End Raising Your Living Standard In Todays Economy And When You Retire

Price:

$9.99

/month

Book details

ISBN: 1416548912, 978-1416548911

Book publisher: Simon & Schuster

Get your hands on the best-selling book Spend Til The End Raising Your Living Standard In Todays Economy And When You Retire 1st Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: • Financial planning is more important than ever: The recession has demonstrated that lifetime financial planning is essential if we are going to survive and overcome the shocks and bruises that the economy brings..• Takes on the financial-planning establishment: Economist Laurence J. Kotlikoff and syndicated financial columnist Scott Burns criticize major financial institutions such as Fidelity, Vanguard, and other mutual funds and insurers for offering what they call “rules of dumb,” financial planning information that is inadequate for most people’s needs..• Unconventional, economics-based advice: You might be better off waiting until age seventy to take Social Security; you may be overestimating the tax benefits of your mortgage; you might be scrimping, saving, and struggling to fund your retirement when you could be spending and enjoying your money..

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Michelle Duran

( 5 )

"Delivery was considerably fast, and the book I received was in a good condition."