Go back

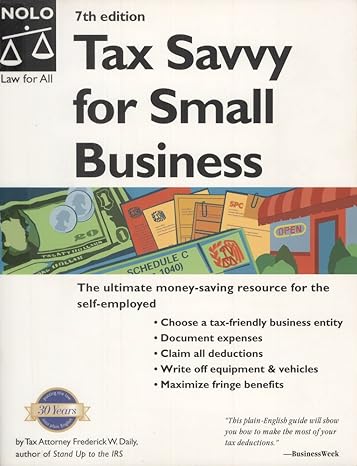

Tax Savvy For Small Business The Ultimate Money Saving Resource For The Self Employed(7th Edition)

Authors:

Frederick W. Daily

Cover Type:Hardcover

Condition:Used

In Stock

Shipment time

Expected shipping within 2 DaysPopular items with books

Access to 30 Million+ solutions

Free ✝

Ask 50 Questions from expert

AI-Powered Answers

✝ 7 days-trial

Total Price:

$0

List Price: $6.36

Savings: $6.36(100%)

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Tax Savvy For Small Business The Ultimate Money Saving Resource For The Self Employed

Price:

$9.99

/month

Book details

ISBN: 0873379721, 978-0873379724

Book publisher: Nolo

Get your hands on the best-selling book Tax Savvy For Small Business The Ultimate Money Saving Resource For The Self Employed 7th Edition for free. Feed your curiosity and let your imagination soar with the best stories coming out to you without hefty price tags. Browse SolutionInn to discover a treasure trove of fiction and non-fiction books where every page leads the reader to an undiscovered world. Start your literary adventure right away and also enjoy free shipping of these complimentary books to your door.

Book Summary: Knowing the ins and outs of the tax code is vital to the health of every small business. Virtually every decision a business makes has tax consequences that can affect its bottom line -- and the IRS is always watching. Fortunately, Tax Savvy for Small Business provides valuable strategies that will free up your time and money for what counts: running your business, and running it effectively. It explains how to: *deduct current and capitalized expenses *write off long-term assets *write off up to $24,000 of long-term assets each year *compare the advantages of different legal structures *take advantage of fringe benefits *keep records that will head off trouble with the IRS *get tax breaks from business losses *pay payroll taxes on time *deduct home-office expenses *negotiate payment plans for late taxes *handle an audit *get IRS penalties and interest reduced *maximize retirement funds *use retirement funds as a tax break Completely updated, the 7th edition provides the latest tax breaks, rules, forms and publications. An essential book for entrepreneurs, independent contractors, small-business owners and anyone else making money on their own -- get it today!

Customers also bought these books

Frequently Bought Together

Top Reviews for Books

Request 737qr6c

( 4 )

"Delivery was considerably fast, and the book I received was in a good condition."