The Drillago Co. is involved in searching for locations in which to drill for oil. The firm's

Question:

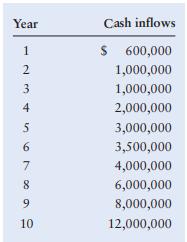

The Drillago Co. is involved in searching for locations in which to drill for oil. The firm's current project requires an initial investment of $15 million and has an estimated life of 10 years. The expected future cash inflows for the project are as shown in the following table:

The firms current cost of capital is 13%.

A. Calculate the project's net present value (NPV). Is the project acceptable under the NPV technique? Explain.

B. Calculate the project's internal rate of return (IRR). Is the project acceptable under the IRR technique? Explain.

C. In this case, did the two methods produce the same results? Generally, is there a preference between the NPV and IRR techniques? Explain.

D. Calculate the payback period for the project. If the firm usually accepts projects that have payback periods between 1 and 7 years, is this project acceptable?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Payback Period

Payback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Step by Step Answer:

Fundamentals of Corporate Finance

ISBN: 978-0077861629

8th Edition

Authors: Stephen A. Ross, Randolph W. Westerfield, Bradford D.Jordan