Question: Using the information given in Exercise 5Apx-1A and the rates shown in Figure 5A-4, prepare a depreciation schedule showing the depreciation expense, accumulated depreciation, and

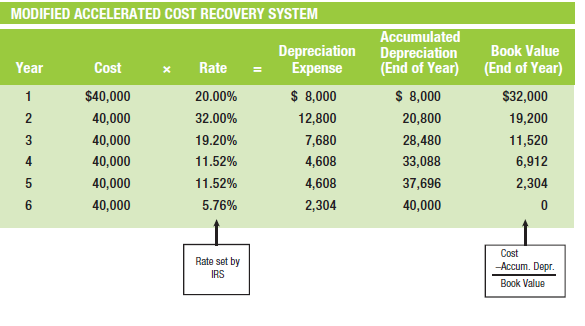

Using the information given in Exercise 5Apx-1A and the rates shown in Figure 5A-4, prepare a depreciation schedule showing the depreciation expense, accumulated depreciation, and book value for each year under the Modified Accelerated Cost Recovery System. For tax purposes, assume that the truck has a useful life of five years. (The IRS schedule will spread depreciation over six years.)

Figure 5A-4

MODIFIED ACCELERATED COST RECOVERY SYSTEM Accumulated Depreciation (End of Year) Depreciation Expense Book Value Year Cost Rate (End of Year) $ 8,000 $ 8,000 $40,000 $32,000 20.00% 2 40,000 32.00% 12,800 20,800 19,200 3 40,000 19.20% 7,680 28,480 11,520 40,000 33,088 4 11.52% 4,608 6,912 4,608 40,000 11.52% 37,696 2,304 2,304 6. 40,000 5.76% 40,000 Cost Rate set by -Accum. Depr. IRS Book Value

Step by Step Solution

3.25 Rating (163 Votes )

There are 3 Steps involved in it

Modified Accelerated Cost Recovery System Year Cost Rate Deprec... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

73-B-A-A-P (403).docx

120 KBs Word File