Yacco Manufacturing Company has four operating divisions. During the first quarter of 2013, the company reported aggregate

Question:

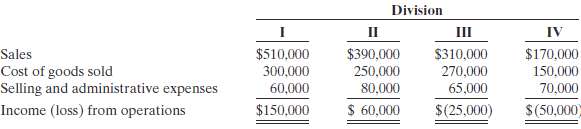

Yacco Manufacturing Company has four operating divisions. During the first quarter of 2013, the company reported aggregate income from operations of $135,000 and the divisional results shown on the next page.

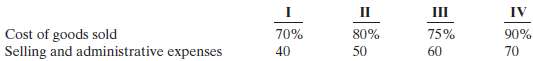

Analysis reveals the following percentages of variable costs in each division.

Discontinuance of any division would save 50% of the fixed costs and expenses for that division.Top management is very concerned about the unprofitable divisions (III and IV). Consensus is that one or both of the divisions should be discontinued.Instructions(a) Compute the contribution margin for Divisions III and IV.(b) Prepare an incremental analysis concerning the possible discontinuance of (1) Division III and (2) Division IV. What course of action do you recommend for each division?(c) Prepare a columnar condensed income statement for Yacco Manufacturing, assumingDivision IV is eliminated. Use the CVP format. Division IV??s unavoidable fixed costs are allocated equally to the continuing divisions.(d) Reconcile the total income from operations ($135,000) with the total income from operations without Division IV.

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso