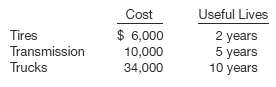

Brazil Group purchases a vehicle at a cost of $50,000 on January 2, 2012.Individual components of the

Question:

Brazil Group purchases a vehicle at a cost of $50,000 on January 2, 2012.Individual components of the vehicle and useful lives are as follows.

Instructions(a) Compute depreciation expense for 2012, assuming Brazil depreciates the vehicle as a single unit.(b) Compute depreciation expense for 2012, assuming Brazil uses component depreciation.(c) Why might a company want to use component depreciation to depreciate itsassets?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: