Flexible-budget variances, review of Chapters. David James is a cost accountant and business analyst for Doorknob Design

Question:

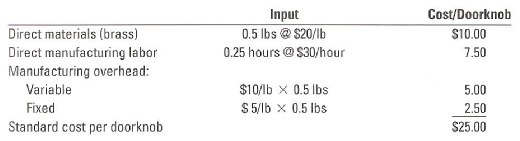

Flexible-budget variances, review of Chapters. David James is a cost accountant and business analyst for Doorknob Design Company (DDC), which manufactures expensive brass doorknobs. DDC uses two direct cost categories: direct materials and direct manufacturing labor. James feels that manufacturing overhead is most closely related to material usage. Therefore, DDC allocates manufacturing overhead head to production based upon pounds of materials used.

At the beginning of 2009, DUC budgeted production of 100,000 doorknobs and adopted the following standards for each doorknob:

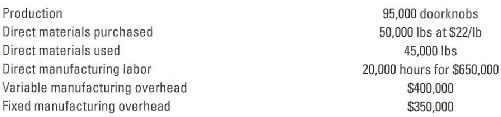

Actual results for April 2009 were:

1. For the month of April, compute the following variances, indicating whether each is favorable (F) or unfavorable (U).

a. Direct materials price variance (based on purchases).

b. Direct materials efficiency variance.

c. Direct manufacturing labor price variance

d. Direct manufacturing labor efficiency variance

e. Variable manufacturing overhead spending variance

f. Variable manufacturing overhead efficiency variance

g. Production-volume variance

h. Fixed manufacturing overhead spending variance

2. Can James use any of the variances to help explain any of the other variances? Give examples.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav