John Corporation acquired a 70 percent interest in Jojo Corporation on April 1, 2011, when it purchased

Question:

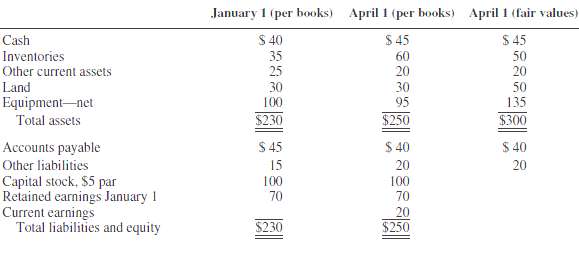

John Corporation acquired a 70 percent interest in Jojo Corporation on April 1, 2011, when it purchased 14,000 of Jojo's 20,000 outstanding shares in the open market at $13 per share. Additional costs of acquiring the shares consisted of $10,000 legal and consulting fees. Jojo Corporation's balance sheets on January 1 and April 1, 2011, are summarized as follows (in thousands):

ADDITIONAL INFORMATION1. The overvalued inventory items were sold in September 2011.2. The undervalued items of equipment had a remaining useful life of four years on April 1, 2011.3. Jojo's net income for 2011 was $80,000 ($60,000 from April to December 31, 2011).4. On December 1, 2011, Jojo declared dividends of $2 per share, payable on January 10, 2012.5. Any unidentified assets of Jojo are not amortized.REQUIRED1. Prepare a schedule showing how the difference between John's investment cost and book value acquired should be allocated to identifiable and/or unidentifiable assets.2. Calculate John's investment income from Jojo for 2011.3. Determine the correct balance of John's Investment in Jojo account at December 31,2011.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith