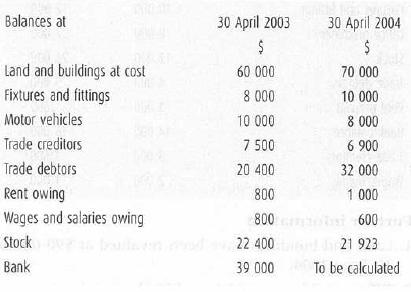

Korn, a retailer, does not keep proper books of account but he has provided the following information

Question:

Korn, a retailer, does not keep proper books of account but he has provided the following information about his business.

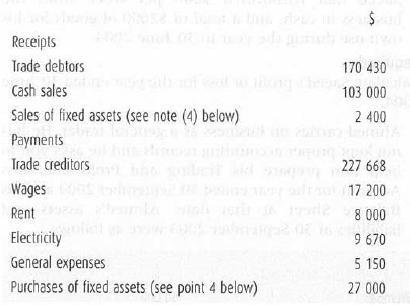

Korn's bank account transactions for the year ended 30 April 2004 were as follows.

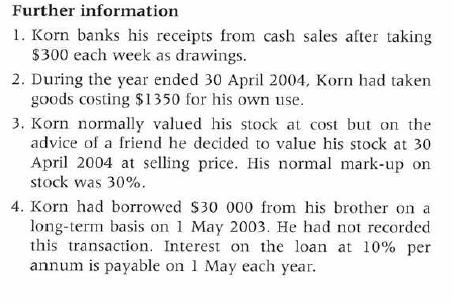

Further information

Further information

1. Korn banks his receipts from cash sales after taking $300 each week as drawings.

2. During the year ended 30 April 2004, Korn had taken goods costing $1350 for his own use.

3. Korn normally valued his stock at cost but on the advice of a friend he decided to value his stock at 30 April 2004 at selling price. His normal mark-up on stock was 30%.

4. Korn had borrowed $30 000 from his brother on a long-term basis on 1 May 2003. He had not recorded this transaction. Interest on the loan at 10% per annum is payable on 1 May each year.

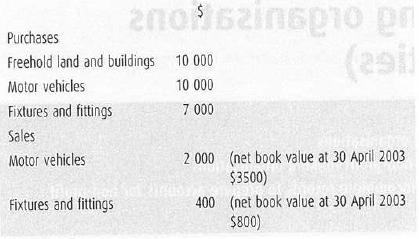

During the financial year ended 30 April 2004 the following transactions had taken place.

Required

(a) Prepare Korn's Trading and Profit and Loss Account for the year ended 30 April 2004.

(b) Prepare the Balance Sheet at 30 April 2004.

(c) Comment on the suggestion by Korn's friend that stock should be valued at selling price, and refer to any relevant accounting principle.

Step by Step Answer: