Question:

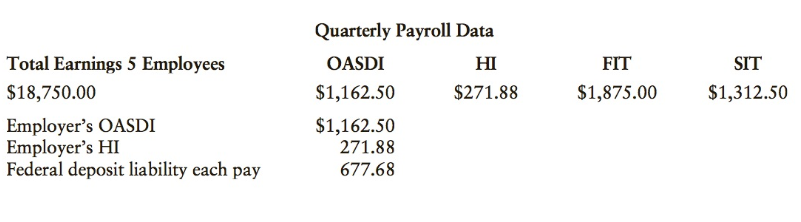

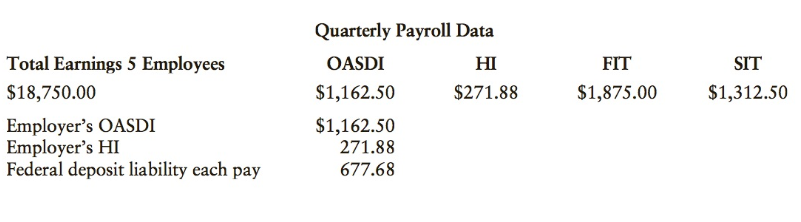

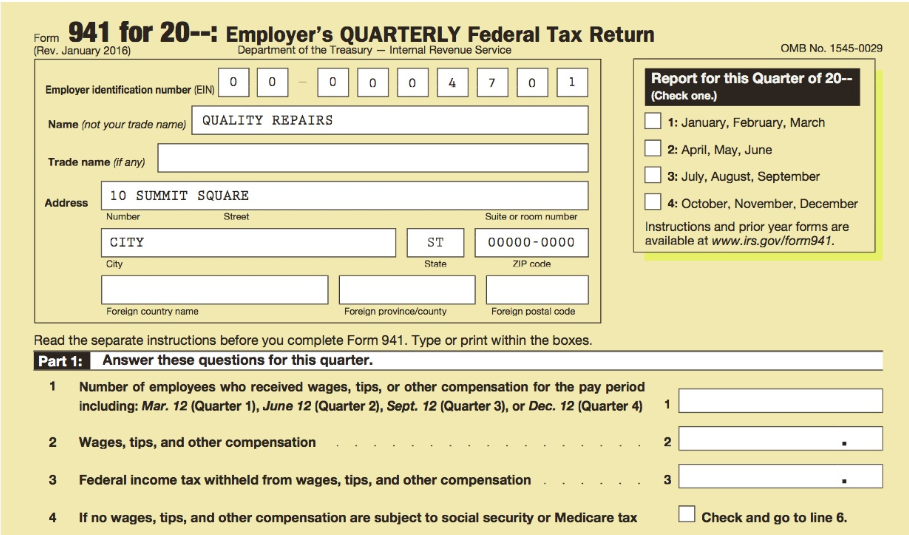

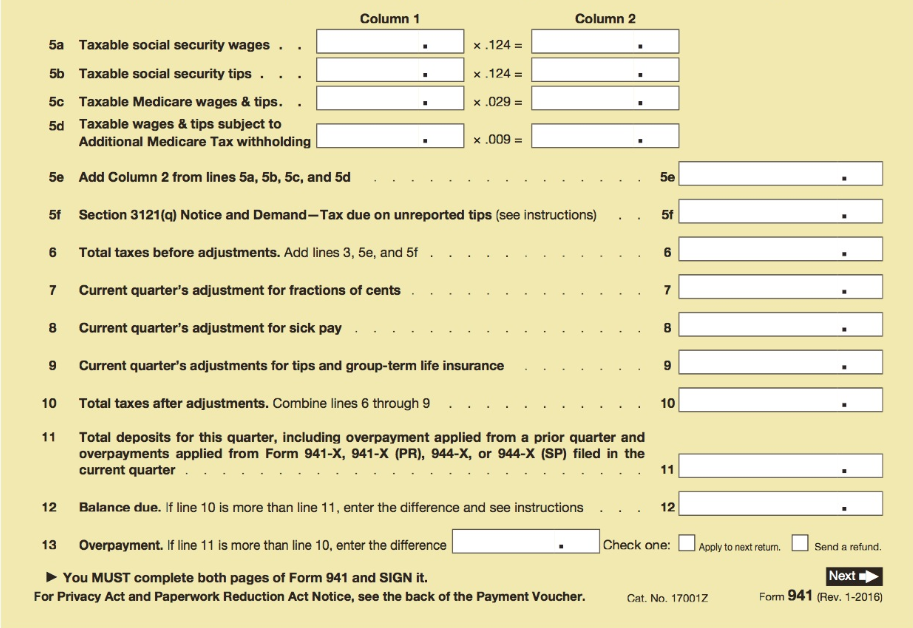

During the fourth quarter of 2017, there were seven biweekly paydays on Friday (October 6, 20; November 3, 17; December 1, 15, 29) for Quality Repairs. Using the forms supplied on pages 4-44 to 4-47, complete the following for the fourth quarter:

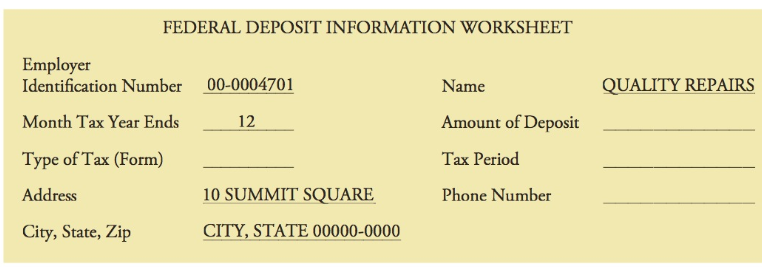

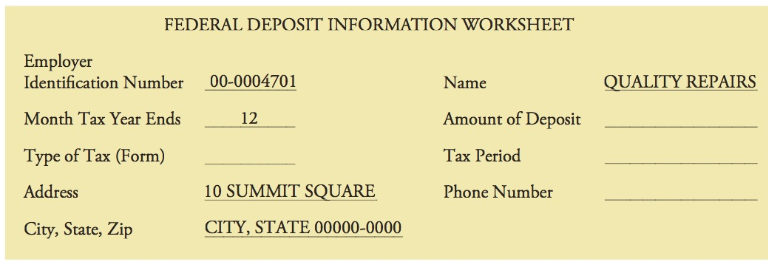

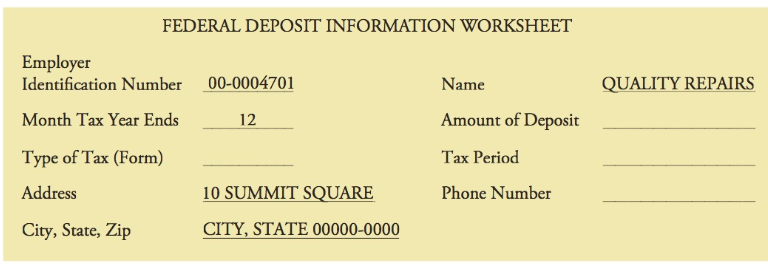

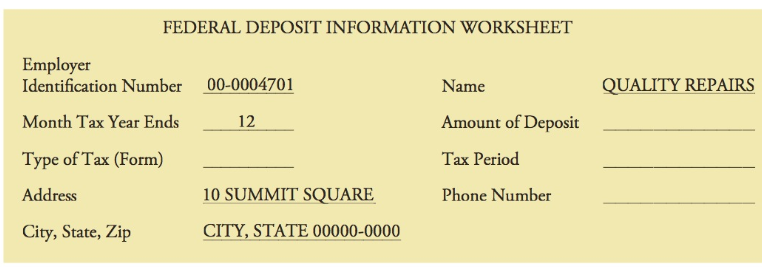

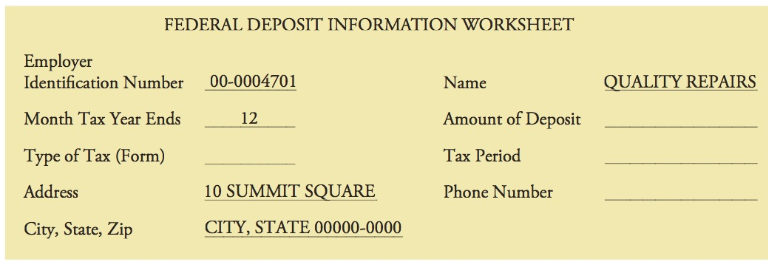

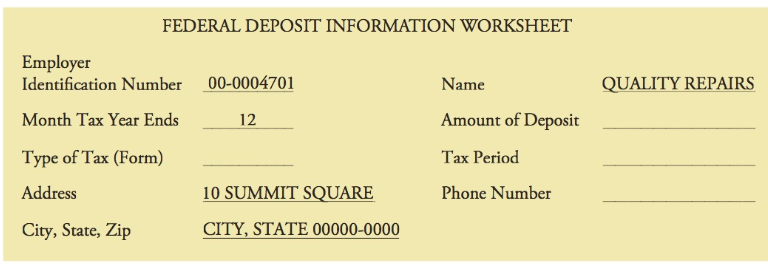

a. Complete the Federal Deposit Information Worksheets reflecting electronic deposits (monthly depositor). The employer€™s phone number is (501) 555-7331. Federal deposit liability each pay, $677.68.

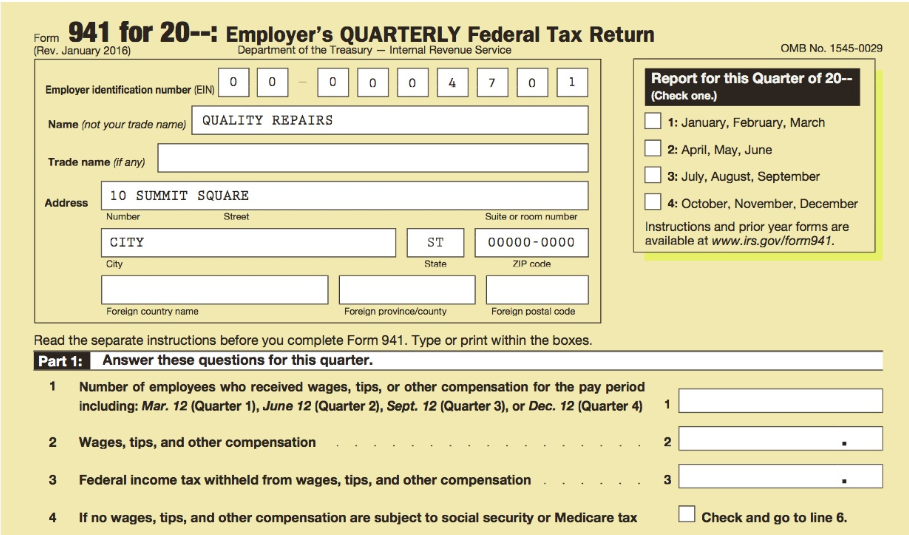

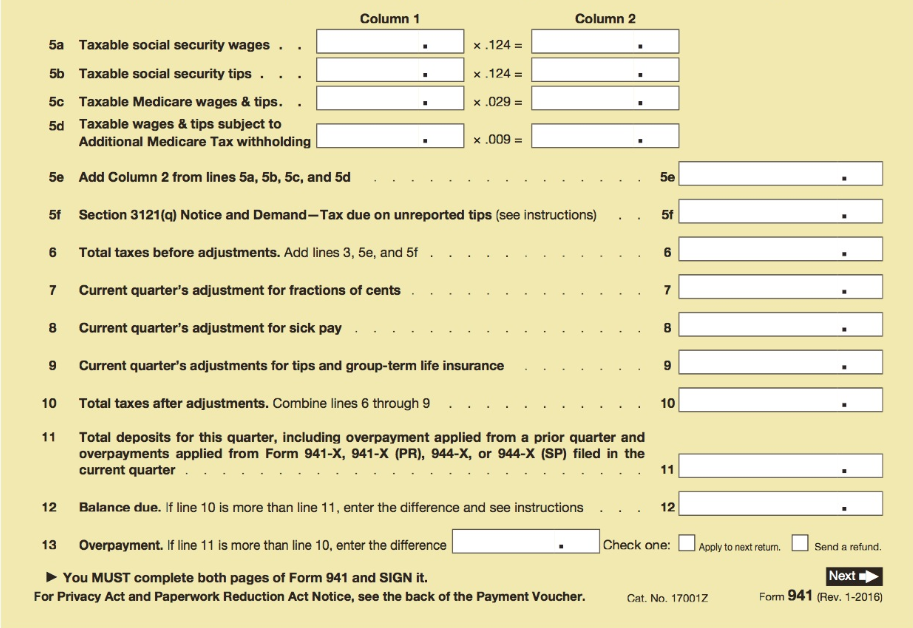

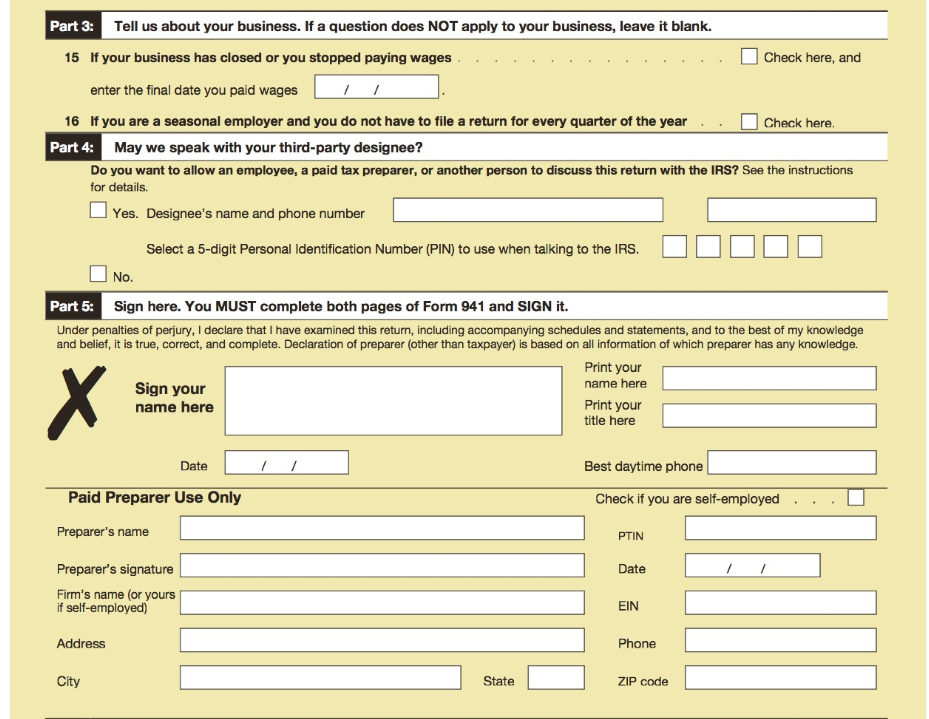

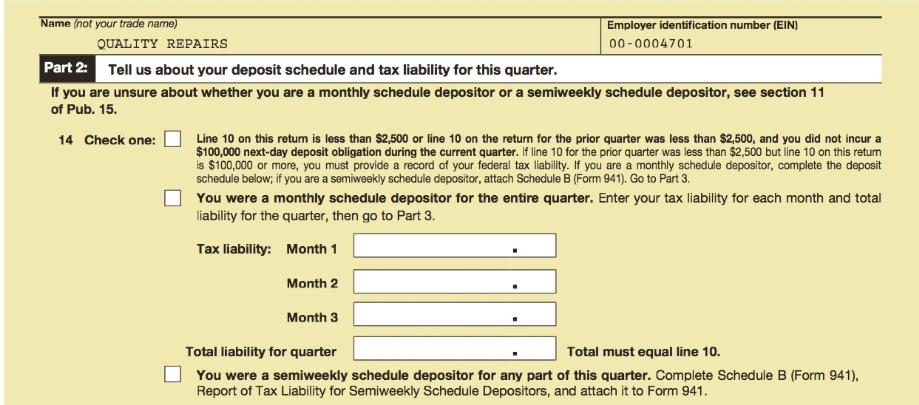

b. Employer€™s Quarterly Federal Tax Return, Form 941. The form is signed by you as president on January 31, 2018.

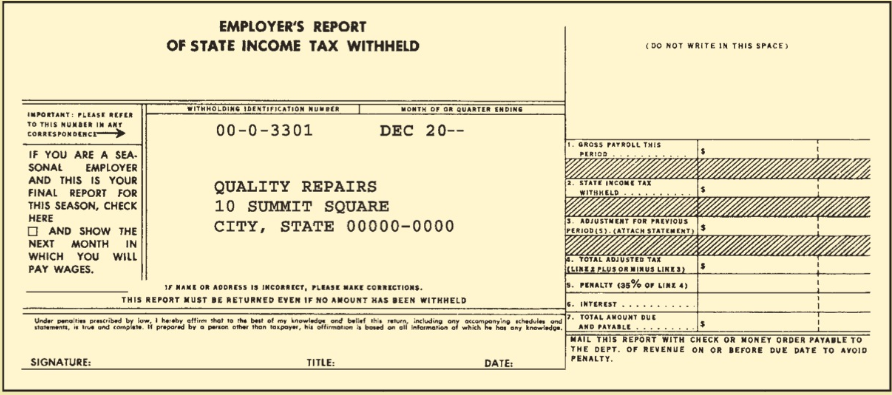

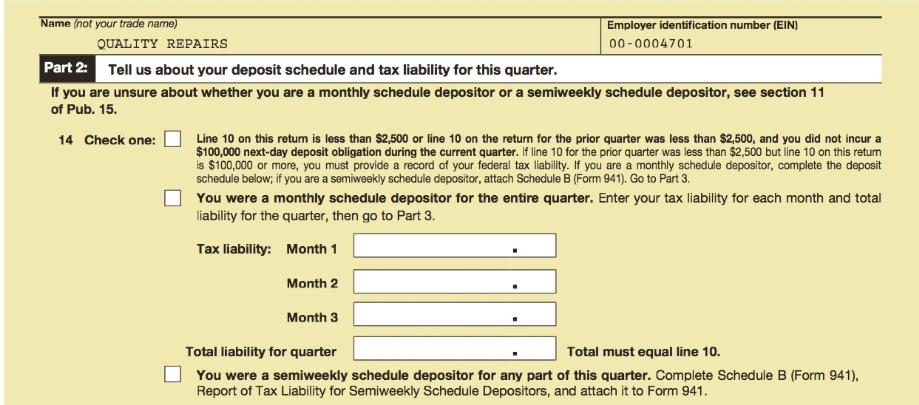

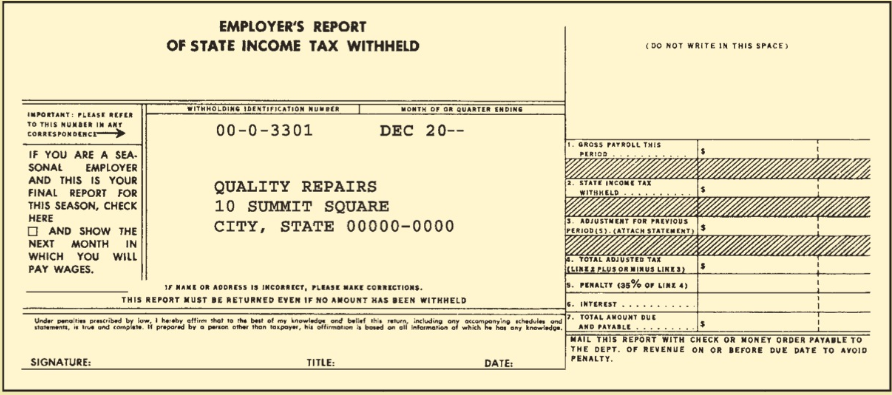

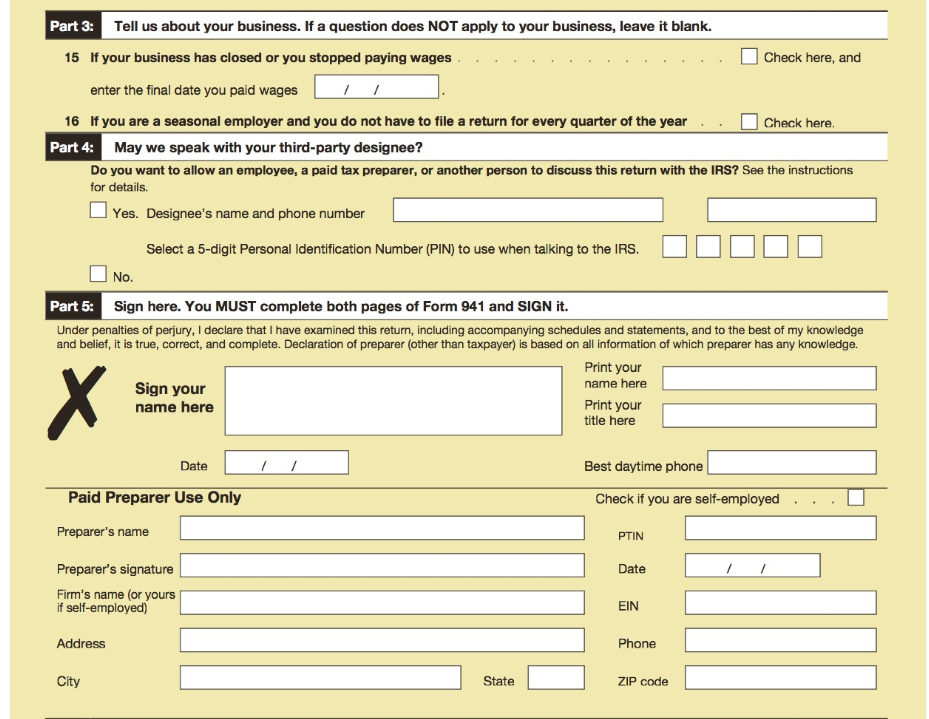

c. Employer€™s Report of State Income Tax Withheld for the quarter, due on or before January 31, 2018.

To be deposited on or before _____________

To be deposited on or before ______________

To be deposited on or before ______________

Transcribed Image Text:

Quarterly Payroll Data Total Earnings 5 Employees OASDI FIT SIT HI $1,312.50 $271.88 $18,750.00 $1,162.50 $1,875.00 Employer's OASDI Employer's HI Federal deposit liability each pay $1,162.50 271.88 677.68 EMPLOYER'S REPORT OF STATE INCOME TAX WITHHELD ( DO NOT WRITE IN THIS SPACE) CITHHOLDING IDENTITICATION NUTEA MONTH OF OR QUARTER ENDIN INPORTANT: PLEASE REFER TO THIS NUMBER IN ANT CORRESPONDENCC 00-0-3301 DEC 20-- 1. GROSS PATROLL THIS PERIO IF YOU AREA SEA. SONAL AND THIS IS YOUR EMPLOYER 2. STATE INCOME TAX WITHHELD QUALITY REPAIRS 10 SUMMIT SQUARE CITY, STATE 00000-0000 FINAL REPORT FOR THIS SEASON, CHECK HERE O AND SHOW s. ADJUSTNENT FOR PREVIOUS PERIOD(S). (ATTACH STATEMENT) НЕ NEXT WHICH YOU WILL PAY WAGES. MONTH IN 4. TOTAL ADJUSTED TAK IELINEA PLUS OR MINUS LINE3) s. PENALTY (38% or LINE 4) 1F MAKE OR ADDRESS IS INCORRECT, PLEASE MAKE CORRECTIONS. THIS REPORT MUuST BE RETURNED EVEN IF NO ANOUNT HAS BEEN WITHHELD s. INTEREST.... Under penaities prescribed by iow, I hereby effire that to the best of my knowledge ond belef this return, including ony accompanying schedules ond OTAL AROUAT BUt statemente, is rue and complete. H preparad by o person other than taxpayer, hia oftirmation a bosed on sll informanion of which he has any knewiedge. AND PAYABLE.. MAIL THIS REPORT WITH CHECK OR MONEY ORDER PAYABLE TO THE DEPT. OF REVENUE ON OR BEFORE DUE DATE TO AVOID PENALTY. SIGNATURE: TITLE: DATE: