For the year ended December 31, 2020, Denkinger Electrical Repair Company reports the following summary payroll data.

Question:

For the year ended December 31, 2020, Denkinger Electrical Repair Company reports the following summary payroll data.

Gross earnings:

Administrative salaries ............................... $200,000

Electricians’ wages ......................................... 370,000

Total .................................................................. $570,000

Deductions:

FICA taxes ............................................................................ $ 38,645

Federal income taxes withheld .................................... 174,400

State income taxes withheld (3%) ................................ 17,100

United Fund contributions payable ............................. 27,500

Health insurance premiums ........................................... 17,200

Total .................................................................................... $274,845

Denkinger’s payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable employment record), and 0.8% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $490,000, and gross earnings subject to unemployment taxes total $135,000. No employee exceeds the $127,200 limit related to FICA taxes.

Instructions

a. Prepare a summary journal entry at December 31 for the full year’s payroll.

b. Journalize the adjusting entry at December 31 to record the employer’s payroll taxes.

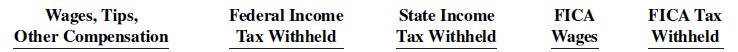

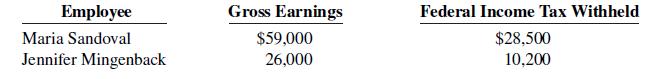

c. The W-2 Wage and Tax Statement requires the following dollar data.

Complete the required data for the following employees.

Step by Step Answer:

Accounting Principles

ISBN: 978-1119411482

13th edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso