Co A is a foreign subsidiary of Parent Co. For purposes of consolidation, the foreign currency financial

Question:

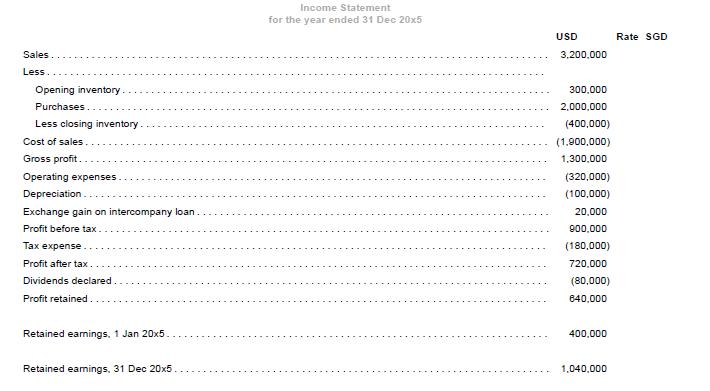

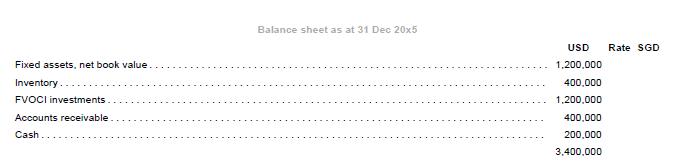

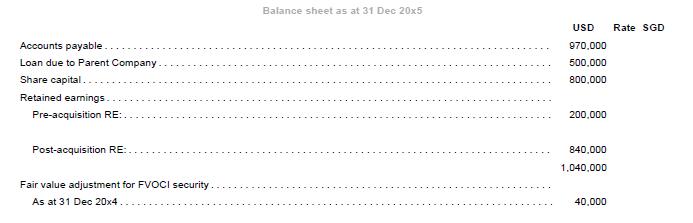

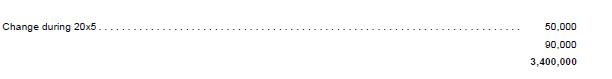

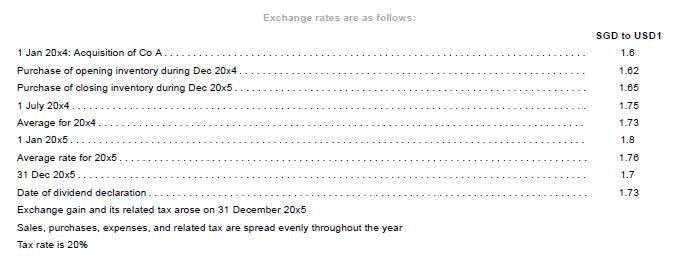

Co A is a foreign subsidiary of Parent Co. For purposes of consolidation, the foreign currency financial statements of Company A have to be translated from its functional currency (the USD) to the presentation currency (the SGD). Complete the table below by inserting the appropriate rates and completing the SGD column.

Other information

(1) Loan due to Parent Company has no fixed terms of repayment and is deemed an extension of the parent’s net investment in Co A. The exchange gain should be reclassified to FCTR in the group financial statements.

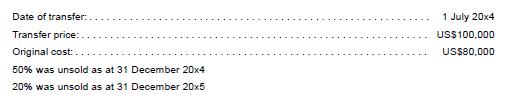

(7) Co A sold inventory to Parent as follows:

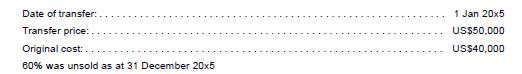

(8) Parent Co sold inventory to Co A as follows:

(9) Percentage ownership by NCI 20%

Percentage ownership by Parent 80%

Required

(a) Translate the financial statements into the presentation currency.

(b) Reconcile the ending balance of the foreign currency translation reserve with the movements in net exposed items of Co A for the year ended 31 December 20x5.

(c) Prepare the consolidation adjustments for Co A for the year ended 31 December 20x5 in Singapore dollars.

(d) Perform an analytical check of NCI in Singapore dollars as at 31 December 20x5.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah