Dagger Company purchased 25 percent of the voting common stock of Lurch Corporation on July (1,20 times

Question:

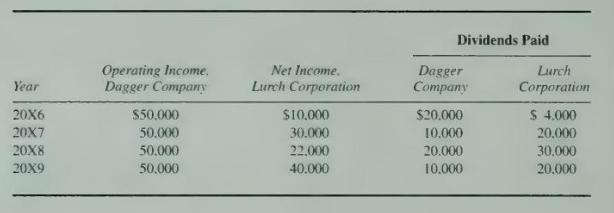

Dagger Company purchased 25 percent of the voting common stock of Lurch Corporation on July \(1,20 \times 6\) at \(\$ 10.000\) over underlying book value. The excess all relates to amortizable assets with a remaining life of 10 years. Both companies report on a calendar-year basis and pay dividends at the end of the year. All income is earned evenly throughout the year. The following income and dividend information is provided by the companies at the end of \(20 \mathrm{X} 9\) :

\section*{Required}

Compute net income for Dagger Company for each of the years using

(a) the cost method and

(b) the equity method.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King

Question Posted: