Select the correct answer for each of the following questions. 1. On July 1, 20X3, Barker Company

Question:

Select the correct answer for each of the following questions.

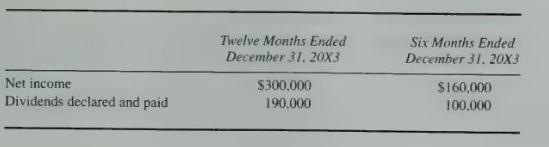

1. On July 1, 20X3, Barker Company purchased 20 percent of the outstanding common stock of Acme Company for \(\$ 400,000\) when the fair value of Acme's net assets was \(\$ 2,000,000\). Barker does not have the ability to exercise significant influence over the operating and financial policies of Acme. The following data concerning Acme are available for 20X3:

In its income statement for the year ended December 31, 20X3, how much income should Barker report from this investment?

a. \(\$ 20,000\).

b. \(\$ 32.000\).

c. \(\$ 38,000\).

d. \(\$ 60,000\).

2. On January 1, 20X3, Miller Company purchased 25 percent of Wall Corporation's common stock; no goodwill resulted from the purchase. Miller appropriately carries this investment at equity, and the balance in Miller's investment account was \(\$ 190,000\) on December 31, 20X3. Wall reported net income of \(\$ 120,000\) for the year ended December 31, 20X3 , and paid dividends on its common stock totaling \(\$ 48,000\) during \(20 \times 3\). How much did Miller pay for its 25 percent interest in Wall?

a. \(\$ 172,000\).

b. \(\$ 202,000\).

c. \(\$ 208,000\).

d. \(\$ 232,000\).

3. On January 1, 20X7, the Robohn Company purchased for cash 40 percent of the 300,000 shares of voting common stock of the Lowell Company for \(\$ 1,800,000\) when 40 percent of the underlying equity in the net assets of Lowell was \(\$ 1,740,000\). The payment in excess of underlying equity was assigned to amortizable assets with a remaining life of six years. The amortization is not deductible for income tax reporting. As a result of this transaction, Robohn has the ability to exercise significant influence over the operating and financial policies of Lowell. Lowell's net income for the year ended December 31, 20X7, was \(\$ 600,000\). During 20X7, Lowell paid \(\$ 325,000\) in dividends to its shareholders. The income reported by Robohn for its investment in Lowell should be:

a. \(\$ 120,000\).

b. \(\$ 130,000\).

c. \(\$ 230,000\).

d. \(\$ 240,000\).

4. In January 20X0, Farley Corporation acquired 20 percent of the outstanding common stock of Davis Company for \(\$ 800,000\). This investment gave Farley the ability to exercise significant influence over Davis. The book value of the acquired shares was \(\$ 600,000\). The excess of cost over book value was attributed to an identifiable intangible asset, which was undervalued on Davis's balance sheet and which had a remaining economic life of 10 years. For the year ended December 31, 20X0, Davis reported net income of \(\$ 180,000\) and paid cash dividends of \(\$ 40,000\) on its common stock. What is the proper carrying value of Farley's investment in Davis on December 31, 20X0?

a. \(\$ 772,000\).

b. \(\$ 780,000\).

c. \(\$ 800,000\).

d. \(\$ 808,000\).

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King