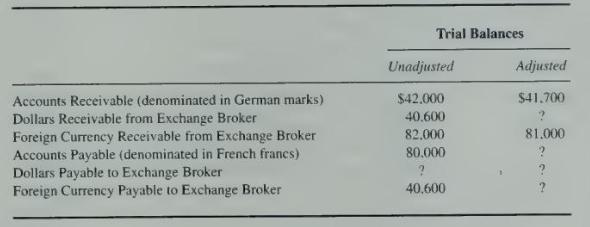

Dexter Inc. had the following items in its unadjusted and adjusted trial balances at December 31, 20X5:

Question:

Dexter Inc. had the following items in its unadjusted and adjusted trial balances at December 31, 20X5:

1. On December 1, 20X5, Dexter sold goods to a company in Germany for 70,000 German marks. Payment in German marks is due on January 30, 20X6. On the transaction date, Dexter entered into a 60-day forward contract to sell 70,000 German marks on January 30, 20X6. The 30-day forward rate on December \(31,20 \times 5\), was DM1 \(=\$ .57\).

2. On October 2, 20X5, Dexter purchased equipment from a French company for 400.000 French francs, payable on January 30, 20X6. On the transaction date, Dexter entered into a 120 -day forward contract to purchase 400,000 French francs on January 30, 20X6. On December 31. 20X5, the spot rate was \(\mathrm{Frl}=\$ .2020\).

\section*{Required}

Using the information contained in the trial balances, answer each of the following questions:

a. What was the indirect exchange rate for German marks on December 1, 20X5? What was the indirect exchange rate on December 31, 20X5?

b. What is the balance in the account Foreign Currency Payable to Exchange Broker in the adjusted trial balance?

c. When Dexter entered into the 60 -day forward contract to sell 70.000 German marks, what was the direct exchange rate for the 60 -day forward contract?

d. What is the amount of Dollars Receivable from Exchange Broker in the adjusted trial balance?

\(e\). What was the indirect exchange rate for French francs on October 2, 20X5? What was the indirect exchange rate on December \(31,20 \mathrm{X} 5\) ?

f. What is the balance in the account Dollars Payable to Exchange Broker in both the unadjusted and the adjusted trial balance columns?

g. When Dexter entered into the 120 -day forward contract to purchase 400,000 French francs, what was the direct exchange rate for the 120 -day forward contract?

h. What was the Accounts Payable balance at December 31, 20X5?

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King