Direct Sales Corporation purchased 60 percent of the stock of Concerto Company on January 1, 20X3, for

Question:

Direct Sales Corporation purchased 60 percent of the stock of Concerto Company on January 1, 20X3, for \(\$ 24.000\) in excess of the underlying book value. The difference relates to goodwill. At December 31, 20X6, the management of Direct Sales reviewed the amount attributed to goodwill and concluded goodwill had been impaired. The correct carrying value at December 31, 20X6, is \(\$ 12,000\).

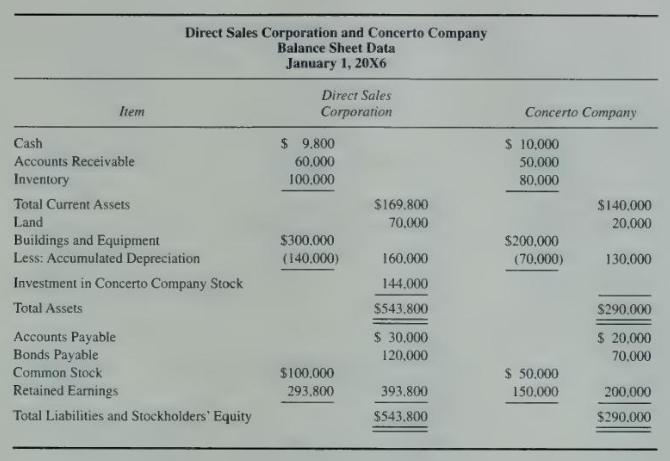

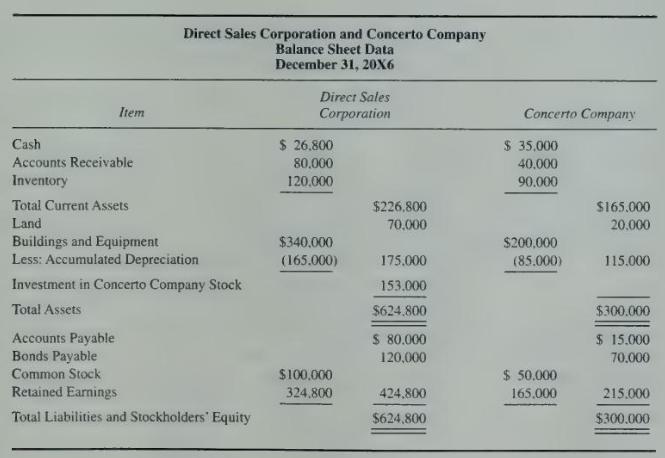

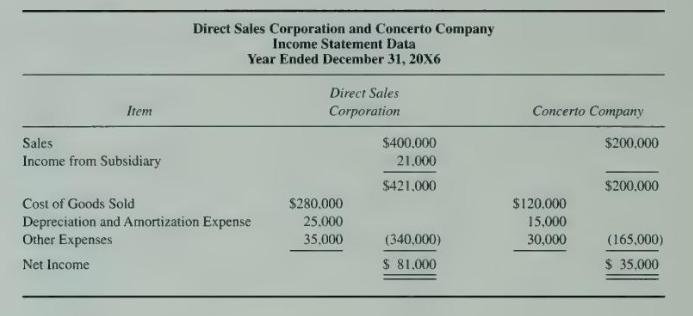

Balance sheet data for January 1, 20X6, and December 31, 20X6, and income statement data for 20X6 for the two companies are as follows:

In 20X4, Concerto Company purchased a piece of land for \(\$ 35,000\) and later in the year sold it to Direct Sales Corporation for \(\$ 45,000\). Direct Sales Corporation is still using the land in its operations.

On January 1, 20X6, Direct Sales Corporation held inventory purchased from Concerto Company for \(\$ 48,000\). During 20X6, Direct Sales purchased an additional \(\$ 90,000\) of goods from Concerto Company and held \(\$ 54,000\) of its purchases on December 31, 20X6. Concerto Company sells inventory to the parent at 20 percent above cost.

Concerto Company also purchases inventory from Direct Sales Corporation. On January 1, 20X6, Concerto held inventory purchased from Direct Sales for \(\$ 14,000\), and on December 31, 20X6, it held inventory purchased from Direct Sales for \(\$ 7,000\). Concerto's total purchases from Direct Sales Corporation were \(\$ 22,000\) in 20X6. Direct Sales Corporation sells items to Concerto Company at 40 percent above cost.

During 20X6. Direct Sales Corporation paid dividends of \(\$ 50,000\), and Concerto Company paid dividends of \(\$ 20,000\).

\section*{Required}

a. Prepare all eliminating entries needed to complete a consolidation workpaper as of December \(31,20 \times 6\).

b. Prepare a three-part consolidation workpaper as of December 31, 20X6.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King