Hart Corporation purchased 70 percent of the voting common shares of Bock Company on January (1,20 times

Question:

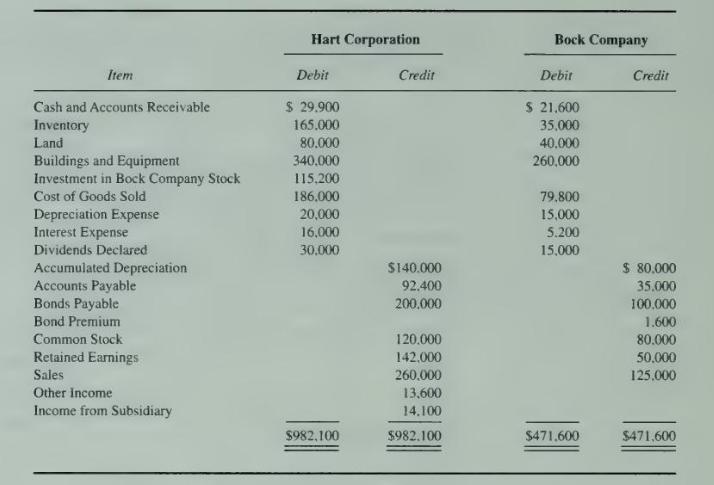

Hart Corporation purchased 70 percent of the voting common shares of Bock Company on January \(1,20 \times 2\), for \(\$ 94,000\). At that date, Bock Company had \(\$ 80,000\) of common stock outstanding and retained earnings of \(\$ 20,000\). The excess of the amount paid over underlying book value is assigned to buildings and equipment which had a fair value \(\$ 20,000\) greater than book value and a remaining 10 -year life and to patents that had a remaining life of five years at the date of the business combination. Trial balances for the companies as of December 31, 20X3, are as follows:

On December 31, 20X2, Bock Company purchased inventory for \(\$ 32,000\) and sold it to Hart Corporation for \(\$ 48,000\). Hart Corporation resold \(\$ 27,000\) of the inventory during 20X3 and had the remaining balance in inventory at December \(31,20 \times 3\).

During 20X3, Bock sold inventory purchased for \(\$ 60,000\) to Hart for \(\$ 90,000\), and Hart resold all but \(\$ 24,000\) of its purchase. On March 10, 20X3, Hart sold inventory purchased for \(\$ 15,000\) to Bock for \(\$ 30,000\). Bock sold all but \(\$ 7,600\) of the inventory prior to December \(31,20 \mathrm{X3}\).

During 20X2, Bock sold land it had purchased for \(\$ 22,000\) to Hart for \(\$ 39,000\). Hart plans to build a warehouse on the property in the near future.

\section*{Required}

a. Give all eliminating entries needed to prepare a full set of consolidated financial statements at December 31, 20X3, for Hart Corporation and Bock Company.

b. Prepare a three-part consolidation workpaper for 20X3.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King