Multiple-Choice Questions on Pooling Treatment [AICPA Adapted] Select the correct answer for each of the follow ing

Question:

Multiple-Choice Questions on Pooling Treatment [AICPA Adapted]

Select the correct answer for each of the follow ing questions.

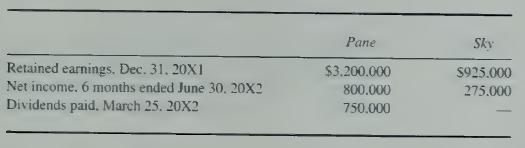

1. On June 30. 20X2. Pane Corporation exchanged 150.000 shares of its S20 par value common stock for all of Sky Corporation's common stock. At that date, the fair \ alue of Pane's common stock issued was equal to the book value of Sky's net assets. Both corporations continued to operate as separate businesses, maintaining accounting records w ith years ending December 3 1 .

Information from separate company operations follows:

If the business combination is accounted for as a pooling of interests, what amount of retained earnings would Pane report in its June 30, 20X2, consolidated balance sheet?

a. S5.200.000.

b. 54,450,000.

c. 53.525,000.

d 53,250,000.

Ethel Corporation issued voting conunon stock with a stated value of 590,000 in exchange for all the outstanding common stock of Lum Company. The combination was properly accounted cfoorm b aisn aa t piooonl i nwga s o fa s i n ftoelrelsotwss.:

What should the increase in stockholders' equity of Ethel Corporation be at the date of acquisition as a result of the business combination?

a. $0.

b. $37,000.

c. $90,000.

d. $127,000.

In a business combination, how should plant and equipment of the acquired corporation generally be reported under each of the following methods?

4. A supportive argument for the pooling of interests method of accounting for a business combination is that:

a. It was developed within the boundaries of the historical cost system and is compatible with it.

b. One company is clearly the dominant and continuing entity.

c. Goodwill is generally a part of any acquisition.

d. A portion of the total cost is assigned to individual assets acquired on the basis of their fair values.

5. On December 31, 20X3, Saxe Corporation was merged into Poe Corporation. In the business combination, Poe issued 200,000 shares of its $ 1 0 par common stock, with a market price of $ 1 8 a share, for all of Saxe's common stock. The stockholders' equity section of each company's balance sheet immediately before the combination was:

Assume the merger qualifies for treatment as a pooling of interest. In the December 31, 20X3, consolidated balance sheet, additional paid-in capital should be reported at:

a. $950,000.

h. $1,300,000.

c. $1,450,000.

d. $2,900,000.

6. On January I, 20X1, Rolan Corporation issued 10,000 shares of common stock in exchange for all Sandin Corporation's outstanding stock. Condensed balance sheets of Rolan and Sandin immediately before the combination are as follows:

Rolan's common stock had a market price of $60 per share on January 1. 20X1, The market price of Sandin's stock was not readily ascertainable. Assuming that the combination of Rolan and Sandin qualifies as a pooling of interests, rather than as a purchase, what should be reported as retained earnings in the consolidated balance sheet immediately after the combination?

a. $500,000.

b. $600,000.

c. $750,000.

d. $850,000.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King