Select the correct answer for each of the following questions. 1. Cedar Company's planned combination with Birch

Question:

Select the correct answer for each of the following questions.

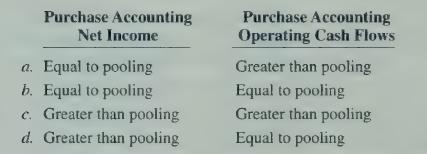

1. Cedar Company's planned combination with Birch Company on January 1, 20X2. can be structured as either a purchase or a pooling of interests. In a purchase. Cedar would acquire Birch's identifiable net assets at less than their book values. These book values approximate fair values. Birch's assets consist of current assets and depreciable noncurrent assets. How would the combined entity's 20X2 net income and operating cash flows under purchase accounting compare to those under pooling of interests accounting? Ignore costs required to effect the combination and income ta.x expense.

2. In a business combination accounted for as a pooling of interests, the combined corporation's retained earnings usually equals the sum of the retained earnings of the individual combining corporations. Assuming there is no contributed capital other than capital stock at par value, which of the following describes a situation where the combined retained earnings must be increased or decreased?

a. Increased if the par value dollar amount of the outstanding shares of the combined corporation exceeds the total capital stock of the separate combining companies.

b. Increased if the par value dollar amount of the outstanding shares of the combined corporation is less than the total capital stock of the combining companies.

c. Decreased if the par value dollar amount of the outstanding shares of the combined corporation exceeds the total capital stock of the separate combining companies.

d. Decreased if the par value dollar amount of the outstanding shares of the combined corporation is less than the total capital stock of the separate combining companies.

3. Two calendar-year corporations combine on July 1. 20X1. The combination is properly accounted for as a pooling of interests. How should the results of operations have been reported for the year ended December 3 1 . 2 0X 1 ?

a. Combined from July 1 to December 3 1 and disclosed for the separate companies from January 1 to June 30.

b. Combined from Juh 1 to December 31 and disclosed for the separate companies for the entire year.

c. Combined for the entire \ear and disclosed for the separate companies from January 1 to June 30.

d. Combined for the entire year and disclosed for the separate companies for the entire year.

4. Costs incurred in effecting a business combination accounted for as a pooling of interests should be:

a. Added to the cost of the investment account of the parent corporation.

b. Deducted from additional paid-in capital of the combined corporation.

c. Deducted in determining net income of the combined corporation for the period in w hich the costs were incurred.

d. Capitalized and subsequently amortized over a period not exceeding 40 years.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King