On January 1, 20X5, Pond Corporation purchased 80 percent of the stock of Skate Company by issuing

Question:

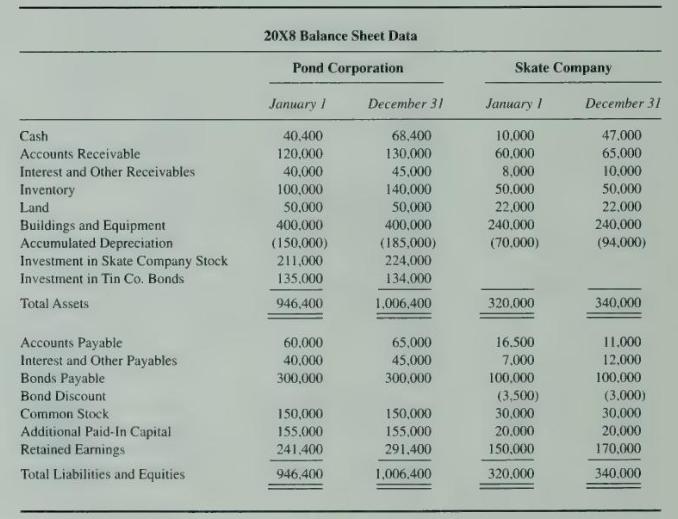

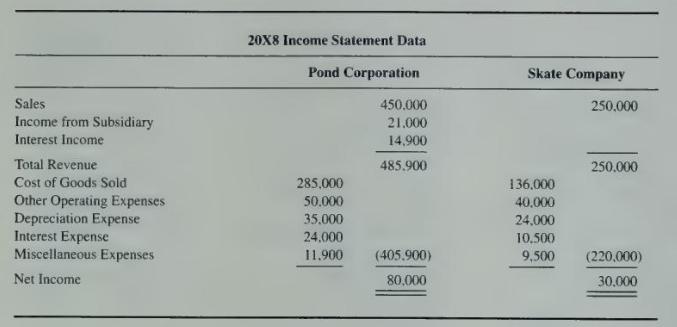

On January 1, 20X5, Pond Corporation purchased 80 percent of the stock of Skate Company by issuing common stock with a fair value of \(\$ 180,000\). At that date, Skate reported retained earnings of \(\$ 100,000\). The balance sheets for Pond and Skate at January 1, 20X8, and December 31, 20X8, and income statements for \(20 \times 8\) were reported as follows:

1. In 20X2 Skate Company developed a patent for a high-speed drill bit that Pond planned to market more extensively. In accordance with generally accepted accounting standards, Skate charges all research and development costs to expense in the year the expenses are incurred. At January 1, 20X5, the estimated market value of the patent rights was estimated to be \(\$ 50,000\). Pond feels the patent will be of value for the next 20 years. The remainder of the purchase differential is assigned to buildings and equipment, which also had an estimated economic life of 20 years at January 1, 20X5. All other assets and liabilities of Skate identified by Pond at the date of acquisition had book values and fair values that were relatively equal.

2. Pond Corporation sold a building to Skate for \(\$ 65.000\) on December 31, 20X7. The building was purchased by Pond for \(\$ 125,000\) and depreciated on a straight-line basis over 25 years. At the time of sale, Pond reported accumulated depreciation of \(\$ 75,000\) and a remaining life of 10 years.

3. On July 1, 20X6, Skate sold land that it had purchased for \(\$ 22,000\) to Pond for \(\$ 35,000\). Pond is planning to build a new warehouse on the property prior to the end of \(20 \mathrm{X} 9\).

4. Both Pond and Skate paid dividends in \(20 \mathrm{X} 8\).

\section*{Required}

a. Give all eliminating entries required to prepare a three-part consolidation working paper at December 31, 20X8

b. Prepare a three-part workpaper for 20X8 in good form.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King