Prime Company holds 80 percent of the stock of Lane Company, acquired on January 1, 20X2, for

Question:

Prime Company holds 80 percent of the stock of Lane Company, acquired on January 1, 20X2, for \(\$ 160,000\). On the date of acquisition, Lane reported retained earnings of \(\$ 50,000\) and had \(\$ 100,000\) of common stock outstanding. Prime uses the basic equity method in accounting for its investment in Lane.

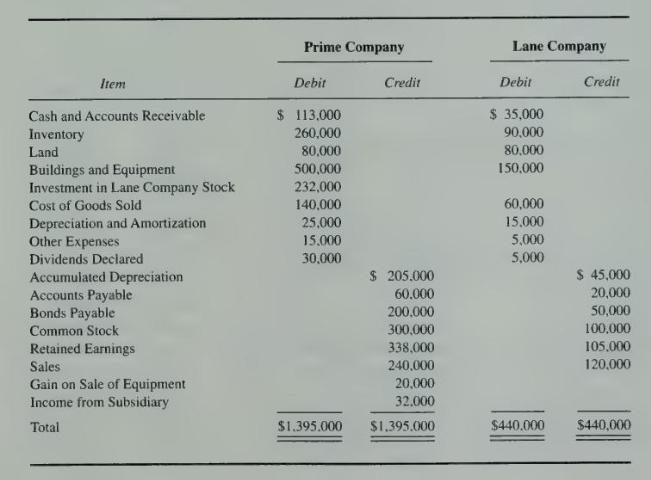

Trial balance data for the two companies on December 31, 20X6, are as follows:

1. At the date of combination, the book values and fair values of all separably identifiable assets of Lane Company were the same. At December 31, 20X6, the management of Prime Company reviewed the amount attributed to goodwill as a result of its purchase of Lane Company stock and concluded an impairment loss of \(\$ 25,000\) should be recognized in 20X6.

2. On January 1, 20X5, Lane Company sold land that had cost \(\$ 8,000\) to Prime Company for \(\$ 18,000\)

3. On January 1, 20X6, Prime Company sold to Lane Company equipment that it had purchased for \(\$ 75,000\) on January 1, 20X1. The equipment has a total economic life of 15 years and was sold to Lane Company for \(\$ 70,000\). Both companies use straight-line depreciation.

4. There was \(\$ 7,000\) of intercompany receivables and payables on December 31, 20X6.

\section*{Required}

a. Give all eliminating entries needed to prepare a consolidation workpaper for 20X6.

b. Prepare a three-part workpaper for 20X6, in good form.

c. Prepare a consolidated balance sheet, income statement, and retained earnings statement for 20X6.

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780072444124

5th Edition

Authors: Richard E. Baker, Valdean C. Lembke, Thomas E. King