You are the chief accountant of Britain plc. Britain plc has a number of subsidiaries located in

Question:

You are the chief accountant of Britain plc. Britain plc has a number of subsidiaries located in various parts of the world. One of these subsidiaries is Faraway Ltd. Faraway Ltd prepares its financial statements in accordance with local Accounting Standards. The accountant of Faraway Ltd has prepared the financial statements for the year ended 30 September 2001 –

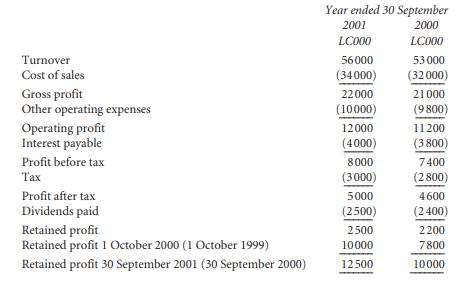

also the accounting reference date of Britain plc. The profit and loss account for the year ended 30 September 2001 (together with comparatives) drawn up in loca1 currency (LC) was as shown below.

The local Accounting Standards that are used in preparing the financial statements of Faraway Ltd are the same as UK Accounting Standards with the exception of the following:

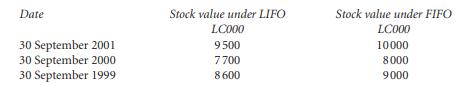

1. Faraway Ltd values its stocks using the LIFO basis. This valuation is acceptable for local tax purposes. Relevant stock values are as follows:

The stock levels of Faraway Ltd often vary from year to year and prices do not rise evenly. The rate of local corporate taxation is 36%.

2. On 1 October 1993, Faraway Ltd acquired an unincorporated business for 50 million units of local currency. The fair value of the net assets of this business on 1 October 1993 was 30 million units of local currency. The resulting goodwill was written off to the profit and loss reserve as permitted by local Accounting Standards. At the date of acquisition, the directors of Faraway Ltd ascertained that the useful economic life of this goodwill was 10 years.

The accountant of Faraway Ltd has sent the financial statements to you with a suggestion that consolidation would be much easier if all group companies used International Accounting Standards to prepare their individual financial statements.

Required

(a) Restate the profit and loss account of Faraway Ltd in local currency (both the current year and the comparative) so as to comply with UK Accounting Standards. (14 marks)

(b) Evaluate the practicality of the suggestion that all group companies should use International Accounting Standards. (6 marks)

CIMA, Financial Reporting – UK Accounting Standards, November 2001 (20 marks)

Step by Step Answer:

Advanced Financial Accounting

ISBN: 9780073526744

7th Edition

Authors: Richard Baker, Valdean Lembke, Thomas King, Cynthia Jeffrey