The ABC Company is considering acquiring the Doggy Corporation. The Doggy Corporation is earning before interest and

Question:

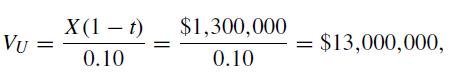

The ABC Company is considering acquiring the Doggy Corporation. The Doggy Corporation is earning before interest and taxes $2 million per year and expects to continue to earn that (for perpetuity), and it has zero debt.

The ABC Company can borrow at a cost of 0.10 and would have a capital structure of 100 percent debt for the Doggy Corporation if it acquired it. The corporate tax rate is 0.35.

Consider only corporate taxes. What is the present value of the Doggy Corporation to the ABC Company? Assume that the following calculation is accepted for VU:

where 0.10 is the appropriate discount factor for the zero-debt cash flows.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Accounting And Managerial Finance A Merger Of Equals

ISBN: 9789814273824

1st Edition

Authors: Harold JR Bierman

Question Posted: