Exercise 6.9 (Equity Swap) In the framework of Example 4.5, we want to use the rate of

Question:

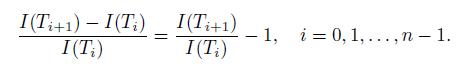

Exercise 6.9 (Equity Swap) In the framework of Example 4.5, we want to use the rate of return of an equity instead of the LIBOR rate. Such a swap is called an equity swap. Let I(t) be the time-t price of an equity. In the “plain vanilla” equity swap, two parties agree to exchange the cash flows based on the fixed interest rate S and those based on the return

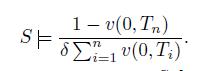

Suppose that the equity swap starts at t = 0. Prove that the swap rate S is given by (4.26), that is,

It should be noted that the equity swap rate S does not depend on the equity return. See Chance and Rich (1998) and Kijima and Muromachi (2001) for details of equity swaps.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Stochastic Processes With Applications To Finance

ISBN: 9781439884829

2nd Edition

Authors: Masaaki Kijima

Question Posted: