Parental Dream Company Ltd buys shares in Sibling 1 and Sibling 2 on 31 December 2017. You

Question:

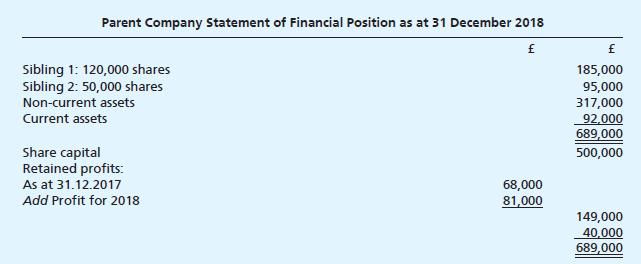

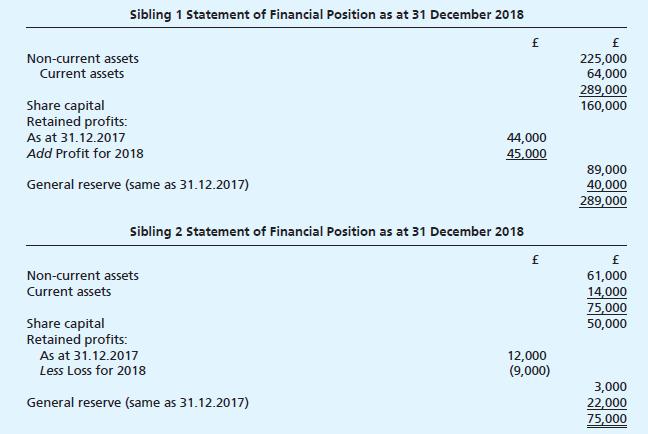

Parental Dream Company Ltd buys shares in Sibling 1 and Sibling 2 on 31 December 2017. You are to draft the consolidated statement of financial position as at 31 December 2018 from the following:

Transcribed Image Text:

Parent Company Statement of Financial Position as at 31 December 2018 £ Sibling 1: 120,000 shares Sibling 2: 50,000 shares Non-current assets Current assets Share capital Retained profits: As at 31.12.2017 Add Profit for 2018 68,000 81,000 £ 185,000 95,000 317,000 92,000 689,000 500,000 149,000 40,000 689,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

To consolidate the statement of financial position for Parental Dream Company Ltd including its subsidiaries Sibling 1 and Sibling 2 we have to combine the assets liabilities and equity of all three e...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster

Question Posted:

Students also viewed these Business questions

-

Question 1 This question has two parts, (A) and (B). Answer both parts. 100% Liverpool plc is a company that manufactures a number of different types of electrical goods and has a year end of 31...

-

The financial statements of JJ Ltd and KK Ltd for the year to 30 June 2018 are shown below: Statements of comprehensive income for the year to 30 June 2018. Statements of financial position as at 30...

-

I know how to perform consolidation for companies with a simple group structure, but Ive not learned how to perform consolidation for companies with a complex group structure. I prepared these draft...

-

Doug, Peter, and Jack have the following capital balances;$150,000, $300,000 and $320,000, respectively. The partners shareprofits and losses 35%, 40%, and 25% respectively. Jones is goingto pay a 2...

-

The McDonald Group purchased a piece of property for $1.2 million. It paid a down payment of 20% in cash and financed the balance. The loan terms require monthly payments for 15 years at an annual...

-

A countrys fertility rate can have a major long-term impact on its economic health. Low fertility rates eventually cause the average age of the population to skew higher, making it more difficult to...

-

Does charting help investors? Some investors believe that charts of past trends in the prices of securities can help predict future prices. Most economists disagree. In an experiment to examine the...

-

U.S. consumers are increasingly viewing debit cards as a convenient substitute for cash and checks. The average amount spent annually on a debit card is $7,790 (Kiplinger's , August 2007). Assume...

-

please help ! 3-22 0 Saved Help SE Marks Corporation has two operating departments, Drilling and Grinding, and an office. The three categories of office expenses are allocated to the two departments...

-

An investor, wants to know how two portfolios are performing in the market: 7% Y (3%) 12% Probability Market portfolio 0.40 0.20 15% 0.40 Beta factor 10% 18% Portfolio X 1.30 10% 8% 4% 0.75 1 The...

-

Parent plc bought 40,000 shares in Subsidiary 1 Ltd and 27,000 shares in Subsidiary 2 Ltd on 31 December 2015. The following statements of financial position were drafted as at 31 December 2016. You...

-

Parents Ltd bought 52% of the shares in Offspring Ltd on 31 October 2017. From the following statements of financial position you are to draw up the consolidated statement of financial position as at...

-

Critics of Sarbanes-Oxley argue that it penalized smaller businesses without bringing about any real change for large corporations. Do you agree or disagree? Why?

-

Given below is some is a comparison of financial performance data of a project when flexibility is incorporated (I.e. flexible project) in comparison to when it is not. (i.e. inflexible project) The...

-

For Service Zone H, assuming your shipment chargeable weight is between 100 and 300 kg, at what weight does it become cheaper to declare the shipment weight to be 300 kg.? EG: What is the rate break...

-

Gold Dust Ltd has produced the following budgeted data for its current financial year:- Sales 2900000 Direct materials 400000 Direct labour 500000 Production overhead 1200000 Production cost 2100000...

-

Critical Review V Hide Assignment Information Instructions Williams, A. (2012). Worry, intolerance of uncertainty, and statistics anxiety. Click on the following link to retrieve the article....

-

(4.) Octopussy Company uses a predetermined overhead rate in applying overhead to production orders on a labor-cost basis for Dept. A and on a machine-hour basis for Dept. B. At the beginning of...

-

Jim Mead is a veterinarian who visits a Vermont farm to examine prize bulls. In order to examine a bull, Jim first gives the animal a tranquilizer shot. The effect of the shot is supposed to last an...

-

For the following arrangements, discuss whether they are 'in substance' lease transactions, and thus fall under the ambit of IAS 17.

-

At the end of 20X5, a parent company, P plc, with one subsidiary had a holding representing 10 per cent of the equity of R Ltd, a clothing company. It had cost 80,000 when purchased at the start of...

-

Why do you think this change in the definition of an associate was made?

-

Relevant balance sheets as at 31 March 20X4 are set out below: You have recently been appointed chief accountant of Jasmin (Holdings) plc and are about to prepare the group balance sheet at 31 March...

-

Problem 12.6A (Algo) Liquidation of a partnership LO P5 Kendra, Cogley, and Mel share income and loss in a 3.21 ratio (in ratio form: Kendra, 3/6: Cogley, 2/6; and Mel, 1/6), The partners have...

-

Melody Property Limited owns a right to use land together with a building from 2000 to 2046, and the carrying amount of the property was $5 million with a revaluation surplus of $2 million at the end...

-

Famas Llamas has a weighted average cost of capital of 9.1 percent. The companys cost of equity is 12.6 percent, and its cost of debt is 7.2 percent. The tax rate is 25 percent. What is the companys...

Study smarter with the SolutionInn App