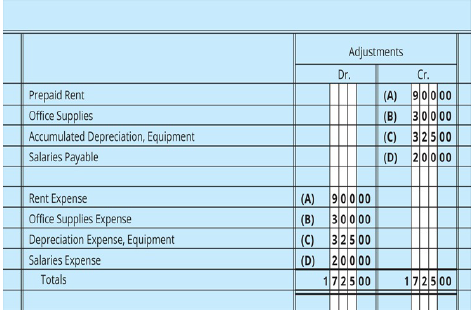

From the adjustments section of a worksheet presented in Figure 5.22 , prepare adjusting journal entries for

Question:

From the adjustments section of a worksheet presented in Figure 5.22 , prepare adjusting journal entries for the end of March.

Transcribed Image Text:

Adjustments Dr. Cr. (A) 90000 (B) 30000 Prepaid Rent Office Supplies Accumulated Depreciation, Equipment Salaries Payable (C) 32500 (D) |2|이이00 (A) 90000 (B) Rent Expense Office Supplies Expense Depreciation Expense, Equipment 30000 (C) 32500 Salaries Expense (D) 20000 Totals 172500 172500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (15 reviews)

Date 201X Account Titles and Description PR Dr Cr Adjusting Entr...View the full answer

Answered By

Shehar bano

I have collective experience of more than 7 years in education. my area of specialization includes economics, business, marketing and accounting. During my study period I remained engaged with a business school as a visiting faculty member and did a lot of business research. I am also tutoring and mentoring number of international students and professionals online for the last 7 years.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

College Accounting A Practical Approach

ISBN: 9780134729312

14th Edition

Authors: Jeffrey Slater, Mike Deschamps

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

From the adjustments section of a worksheet presented in Figure, prepare adjusting journal entries for the end ofJuly. Adjustments Dr. Cr. Prepaid Rent Office Supplies Accumulated Depreciation,...

-

From the adjustments section of a worksheet presented in Figure, prepare adjusting journal entries for the end ofJanuary. Adjustments Dr Cr repaid Rent Office Supplies Accumulated Depreciation,...

-

From the adjustments section of a worksheet presented in Figure 5.22, prepare adjusting journal entries for the end of October. Adjustments Dr Prepaid Rent Office Supplies Accumulated Depreciation,...

-

Given a shaky economy and high heating costs, more and more households are struggling to pay utility bills (The Wall Street Journal, February, 14, 2008). Particularly hard hit are households with...

-

The following information is taken from the records of four different companies in the same industry: Required: 1. Calculate the missing amounts. 2. Which company seems to be performing best? Why?...

-

able to classify research interviews in order to help you to understand the purpose of each type. LO9

-

Would you rather live in the United States, the Dominican Republic, or Haiti?

-

Dunstan Ltd manufactures tents and sleeping bags in three separate production departments. The principal manufacturing processes consist of cutting material in the pattern cutting room, and sewing...

-

Miller Manufacturing has a target debt-equity ratio of .40. Its cost of equity is 11.8 percent and its cost of debt is 6.5 percent. If the tax rate is 21 percent, what is the company's WACC? Round to...

-

9. In a reheat cycle steam at 15 MPa, 540C enters the engine and expands to 1.95 MPa At this point the steam is withdrawn and passed through a reheater. It reenters the engine at 540C. Expansion now...

-

From the following accounts (not in order), prepare a post-closing trial balance for Wey Co. on August 31, 201X. Note: These balances are before closing. Accounts Receivable $18,875 P.Wey, Capital...

-

A series RLC circuit has resistance 127 and impedance 344 . (a) Whats the power factor? (b) If the rms current is 225 mA, whats the power dissipation?

-

Use the NPV method to determine whether Salon Products should invest in the following projects: Project A costs $272,000 and offers eight annual net cash inflows of $60,000. Salon Products requires...

-

ColorCoder is a HousePaint Shop which supplies currently two types of house paints, namely, alpha and beta house paints. The shop is planning to sell a primer (paint base) and the needed paint...

-

which department adds value to a product or service that is observable by a customer?

-

Using Figure 14.1, answer the following questions: a. What was the settle price for July 2022 coffee futures on this date? What is the total dollar value of this contract at the close of trading for...

-

POTI ENTERPRISES LTD. STATEMENT OF INCOME FOR THE YEAR ENDED DECEMBER 31 (current year) SALES $600,000 COST OF SALES: $50,000 OPENING INVENTORY 250,000 PURCHASES 300,000 CLOSING INVENTORY 60,000...

-

10. Describe a qualified defined contribution plan for the self-employed and discuss the advantages and disadvantages in adopting this type of plan. 11. Describe a SEP IRA and discuss the advantages...

-

Why does the equatorial current flow westward?

-

In each of the following independent cases, document the system using whatever technique(s) your instructor specifies. a. Dreambox Creations (www.dreamboxcreations.com/) in Diamond Bar, California,...

-

What is the difference between market value and book value of stock?

-

The stockholders equity of Huerta Company is as follows: Given a redemption value of $108 per share for the preferred stock, calculate the book value per share of preferred and common stock, assuming...

-

What is the purpose of the account Organization Costs?

-

Which investment should I choose? Bond A: BBB Corporate bond, Price=$1,100, Par=$1,000, Coupon rate=4% (semiannual coupons), 13 years to maturity Bond B: BBB Corporate bond, Price=$5,900, Par=$5,000,...

-

During October, total equivalent units of output were 86,000 using the weighted-average method. The information about the beginning and ending inventories for October were as follows: Units in...

-

Q12. PDQ has an expected sales volume of $1,000,000 with a variable cost ratio of 55%, and fixed costs of $200,000. What sales volume would be necessary to achieve a $100,000 after-tax profit when...

Climate Change And Groundwater Special Publication No 288 1st Edition - ISBN: 1862392358 - Free Book

Study smarter with the SolutionInn App