Mancini Florists sells flowers on a retail basis. Most of the sales P.O. 2,3,4,S are for cash;

Question:

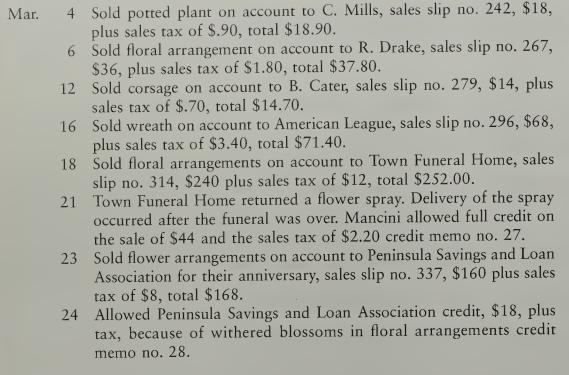

Mancini Florists sells flowers on a retail basis. Most of the sales P.O. 2,3,4,S are for cash; however, a few steady customers have charge accounts. Mancini’s sales staff fills out a sales slip for each sale. The state government levies a 5 per¬

cent retail sales tax, which is collected by the retailer. The following represent Mancini Florists’ charge sales for March:

Instructions 1. Record these transactions in either the sales journal (page 23) or the general journal (page 57).

2. Immediately after recording each transaction, post to the accounts receivable ledger.

3. Post the amounts from the general journal daily. Post the sales journal amounts as a total at the end of the month; 113 Accounts Receivable, 411 Sales, 214 Sales Tax Payable, 412 Sales Returns and Allowances.

4. Prepare a schedule of accounts receivable and compare its total with the Accounts Receivable account.

Check Figure Schedule of Accounts Receivable total, $608.92

Step by Step Answer:

College Accounting Chapters 1-26

ISBN: 9780395796993

6th Edition

Authors: Douglas J. McQuaig, Patricia A. Bille