As a result of several mergers and acquisitions, stock in four companies has been distributed among the

Question:

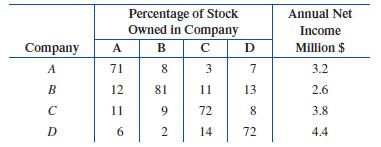

As a result of several mergers and acquisitions, stock in four companies has been distributed among the companies. Each row of the following table gives the percentage of stock in the four companies that a particular company owns and the annual net income of each company (in millions of dollars):

So company A holds 71% of its own stock, 8% of the stock in company B, 3% of the stock in company C, etc. For the purpose of assessing a state tax on corporate income, the taxable income of each company is defined to be its share of its own annual net income plus its share of the taxable income of each of the other companies, as determined by the percentages in the table. What is the taxable income of each company (to the nearest thousand dollars)?

Step by Step Answer:

College Mathematics For Business Economics, Life Sciences, And Social Sciences

ISBN: 978-0134674148

14th Edition

Authors: Raymond Barnett, Michael Ziegler, Karl Byleen, Christopher Stocker