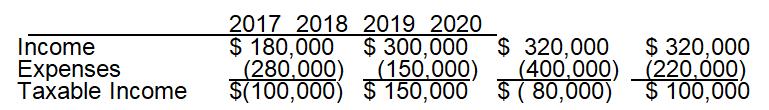

Habiby, Inc., began operations in 2017 and has the following income and expenses for 2017 through 2020.

Question:

Habiby, Inc., began operations in 2017 and has the following income and expenses for 2017 through 2020.

a. What is the amount of tax that Habiby should pay each year?

b. How much would Hadley paid in tax if the old NOL rules were in place but the corporate tax rate was 21 percent?

Transcribed Image Text:

Income Expenses Taxable Income 2017 2018 2019 2020 $180,000 (280,000) $300,000 (150,000) $(100,000) $ 150,000 $ 320,000 (400,000) $(80,000) $ 320,000 (220,000) $100,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (3 reviews)

a b 2017 Habiby would pay no tax in 2017 due to its NOL for that year The NOL can be carried for...View the full answer

Answered By

Usman Nasir

I did Master of Commerce in year 2009 and completed ACCA (Association of Chartered Certified Accountants) in year 2013. I have 10 years of practical experience inclusive of teaching and industry. Currently i am working in a multinational company as finance manager and serving as part time teacher in a university. I have been doing tutoring via many sites. I am very strong at solving numerical / theoretical scenario-based questions.

4.60+

16+ Reviews

28+ Question Solved

Related Book For

Concepts In Federal Taxation

ISBN: 9781337702621

26th Edition

Authors: Kevin E. Murphy, Mark Higgins

Question Posted:

Students also viewed these Business questions

-

Habiby, Inc., began operations in 2019 and has the following income and expenses for 2019 through 2022. a. What is the amount of tax that Habiby should pay each year? b. How much would Hadley paid in...

-

Habiby, Inc., began operations in 2020 and has the following income and expenses for 2020 through 2023. What is the amount of tax that Habiby should pay each year? Income Expenses Taxable Income 2020...

-

You are the senior acquisitions associate at a New York-based private equity fund with a core investment focus. You have reached an agreement to purchase a well-located, 185,000 square foot office...

-

Write a program HowMany that takes a variable number of command-line arguments and prints how many there are.

-

Explain whether LP techniques can be used in each of the following economic settings. a. There are increasing returns to scale in production. b. The objective function and all constraints are linear,...

-

Cash versus Stock as Payment Consider the following premerger information about a bidding firm (Firm B ) and a target firm (Firm T ). Assume that both firms have no debt outstanding. Firm B Firm T...

-

Your firm is considering exporting to two countries: Kenya and Vietnam. However, managements knowledge about the trade policies of these countries is limited. Conduct a search at globalEDGE to...

-

How does EVA differ from residual income?

-

Following are the budgeted income statements for the second quarter of 2019 for SeaTech Inc.: April May June Sales $ 252,000 $ 306,000 $ 342,000 Cost of goods sold* 172,800 205,200 226,800 Gross...

-

1. Prepare a table-based ABC analysis of usage value. Classify as follows: A-items: top 20% of usage value B-items: next 30% of usage value C-items: remaining 50% of usage value 2. Calculate the...

-

When is a taxpayer allowed to deduct a personal casualty loss, and how is it calculated? How would your answer change if Graves were an S corporation?

-

In 2016, Samantha loaned her friend Lo Ping $15,000. The loan required Lo Ping to pay interest at 8% per year and to pay back the $15,000 loan principal on July 31, 2018. Lo Ping used the loan to...

-

There is a requirement to cool 200,000 kg/h of a dilute solution of potassium carbonate from 70 to 30C. Cooling water will be used for cooling, with inlet and outlet temperatures of 20 and 60C. A...

-

POTI ENTERPRISES LTD. STATEMENT OF INCOME FOR THE YEAR ENDED DECEMBER 31 (current year) SALES $600,000 COST OF SALES: $50,000 OPENING INVENTORY 250,000 PURCHASES 300,000 CLOSING INVENTORY 60,000...

-

10. Describe a qualified defined contribution plan for the self-employed and discuss the advantages and disadvantages in adopting this type of plan. 11. Describe a SEP IRA and discuss the advantages...

-

7.) In 1999, the average percentage of women who received prenatal care per country is 80.1%. Table #7.3.9 contains the percentage of woman receiving prenatal care in 2009 for a sample of countries...

-

Describe A demographic profile of the population and community that will be served through the reinvented Human Service program. The description must include all eligibility requirements (i.e.,...

-

You work for a major financial institution. Your branch handles customer calls from a wide variety of individuals. Recently, you've noticed an increase in calls from individuals from African...

-

Refer to the information for Mullett Marina above. Relevant fixed costs associated with this line include 60% of Boat Maintenance's garage/warehouse rent and 50% of Boat Maintenance's supervision...

-

What is your opinion of advertising awards, such as the Cannes Lions, that are based solely on creativity? If you were a marketer looking for an agency, would you take these creative awards into...

-

Wayne owns 30% of Label Maker Corporation. Label Maker is organized as an S corporation. During 2016, Label Maker has a loss of $160,000. At the beginning of 2016, Wayne's at-risk amount in Label...

-

Sidney and Gertrude Pearson own 40% of Bearcave Bookstore, an S corporation. The remaining 60% is owned by their son Boris. Sidney and Gertrude do not participate in operating or managing the store...

-

Mort is the sole owner of rental real estate that produces a net loss of $18,000 in 2015 and $20,000 in 2016 and income of $6,000 in 2017. His adjusted gross income, before considering the rental...

-

When credit terms for a sale are 2/15, n/40, the customer saves by paying early. What percent (rounded) would this savings amount to on an annual basis

-

An industrial robot that is depreciated by the MACRS method has B = $60,000 and a 5-year depreciable life. If the depreciation charge in year 3 is $8,640, the salvage value that was used in the...

-

What determines a firm's beta? Should firm management make changes to its beta? Be sure to consider the implications for the firm's investors using CAPM.

Study smarter with the SolutionInn App