Ed Brandon, the owner of a retail store that sells herbal remedies and nutritional supple ments, has

Question:

Ed Brandon, the owner of a retail store that sells herbal remedies and nutritional supple¬

ments, has requested a cash budget for June. After examining the records of the company, you find the following:

a. Cash balance on June 1 is $1,270.

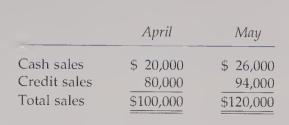

b. Actual sales for April and May are as follows:

c. Credit sales are collected over a three-month period: 50% in the month of sale, 30% in the second month, and 15% in the third month. The remaining sales are uncollectible.

d. Inventory purchases average 80% of a month's total sales. Of those purchases, 70% are paid for in the month of purchase. The remaining 30% are paid for in the following month.

e. Salaries and wages total $4,800 a month.

f. Rent is $1,300 per month.

g. Taxes to be paid in June are $5,000.

h. Ed usually withdraws $4,000 each month as his salary.

i. Advertising is $500 per month.

The owner also tells you that he expects cash sales of $22,000 and credit sales of $90,000 for June. There is no minimum cash balance required. The owner of the company does not have access to short-term loans.

Required:

1. Prepare a cash budget for June. Include supporting schedules for cash collections and cash payments.

2. Did the business show a negative cash balance for June? Assuming that the owner has no hope of establishing a line of credit for the business, what recommendations would you give the owner for dealing with a negative cash balance?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen