Williams, Inc., has compiled the following information on its financing costs: The company is in the 21

Question:

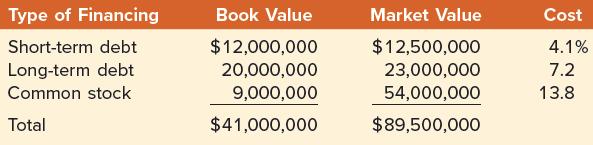

Williams, Inc., has compiled the following information on its financing costs:

The company is in the 21 percent tax bracket and has a target debt-equity ratio of 60 percent. The target short-term debt/long-term debt ratio is 20 percent.

a. What is the company’s weighted average cost of capital using book value weights?

b. What is the company’s weighted average cost of capital using market value weights?

c. What is the company’s weighted average cost of capital using target capital structure weights?

d. What is the difference between WACCs? Which is the correct WACC to use for project evaluation?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted: