2. 23. Portfolio returns and deviations [LO 13.2] Consider the following information about three shares: 1. If

Question:

2. 23.

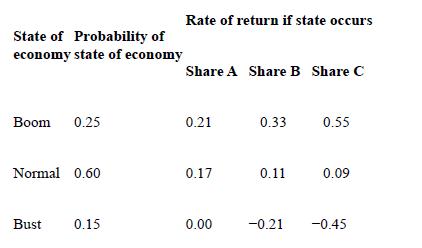

Portfolio returns and deviations [LO 13.2] Consider the following information about three shares:

1. If your portfolio is invested 40 per cent each in A and B and 20 per cent in C, what is the portfolio's expected return? The variance? The standard deviation?

2. If the expected cash rate is 3.80 per cent, what is the expected risk premium on the portfolio?

3. If the expected inflation rate is 3.30 per cent, what are the approximate and exact expected real returns on the portfolio?

What are the approximate and exact expected real risk premiums on the portfolio?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan

Question Posted: