Earnings per share What is the earnings per share for each year between 2012 and 2015 for

Question:

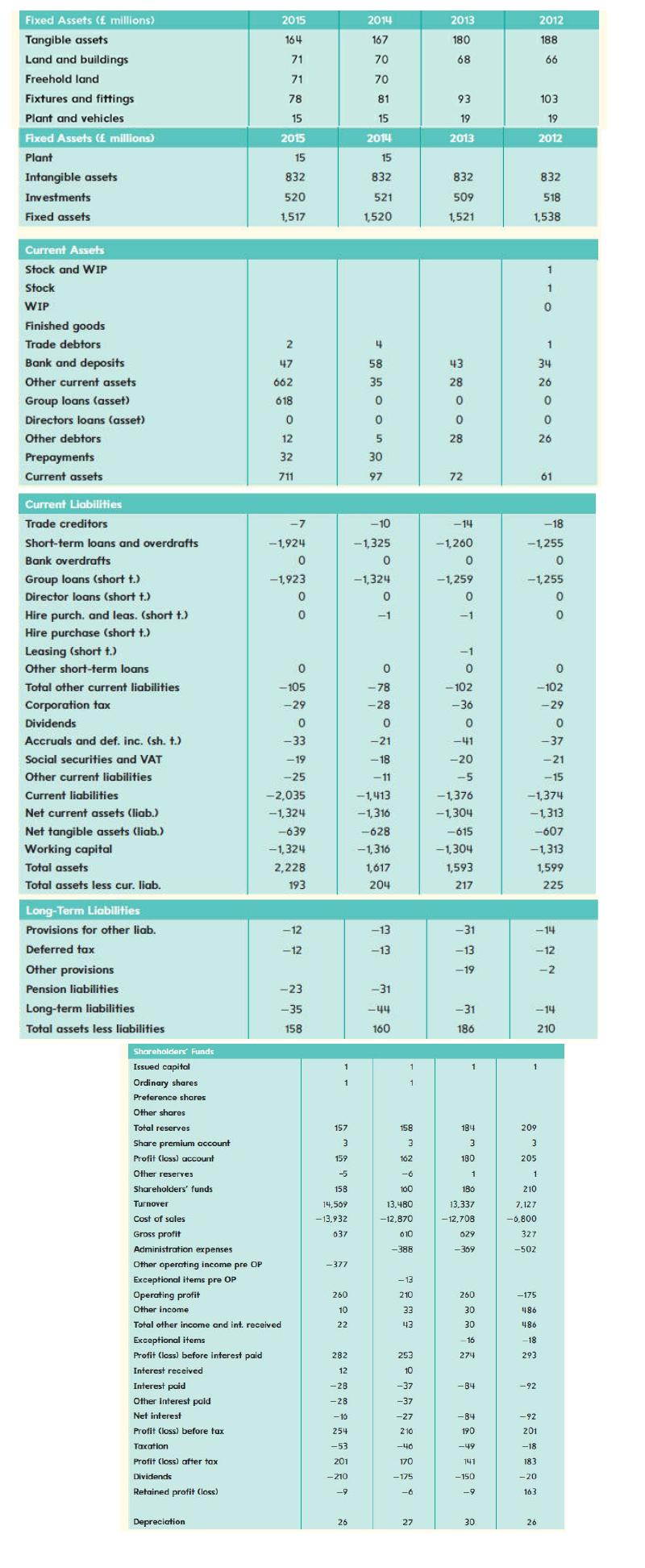

Earnings per share What is the earnings per share for each year between 2012 and 2015 for Montgomery Organizations plc? What is your interpretation of these figures? Is EPS a reliable measure of performance?

Montgomery Organizations plc, whose annual accounts are given below. The firm has 14,685,856 shares and the share price is £2.78.

Transcribed Image Text:

Fixed Assets ( millions) Tangible assets Land and buildings Freehold land Fixtures and fittings Plant and vehicles Fixed Assets ( millions) Plant Intangible assets Investments Fixed assets Current Assets Stock and WIP Stock WIP Finished goods Trade debtors Bank and deposits Other current assets Group loans (asset) Directors loans (asset) Other debtors Prepayments Current assets Current Liabilities Trade creditors Short-term loans and overdrafts Bank overdrafts Group loans (short t.) Director loans (short t.) Hire purch, and leas. (short t.) Hire purchase (short t.) Leasing (short t.) Other short-term loans Total other current liabilities Corpora Dividends Accruals and def. inc. (sh. t.) Social securities and VAT Other current liabilities Current liabilities Net current assets (liab.) Net tangible assets (liab.) Working capital Total assets Total assets less cur. liab. Long-Term Liabilities Provisions for other liab. Deferred tax Other provisions Pension liabilities Long-term liabilities Total assets less liabilities Shareholders Funds Issued capital Ordinary shares Preference shares Other shares Total reserves Share premium account Profit (loss) account Other reserves 2015 164 71 71 78 15 2015 15 832 520 1,517 Depreciation 2 47 662 618 0 12 32 711 -7 -1,924 0 -1,923 0 0 0 -105 -29 0 -33 -19 -25 -2,035 -1,324 -639 -1,324 2,228 193 -12 -12 Shareholders' funds Turnover Cost of sales Gross profit Administration expenses Other operating income pre OP Exceptional items pre OP Operating profit Other income Total other income and int. received. Exceptional items Profit (loss) before interest paid Interest received Interest paid Other Interest paid Net interest Profit (loss) before tax Taxation Profit (loss) after tax Dividends Retained profit (loss) -23 -35 158 1 1 ******* **** ***** -13,932 26 2014 167 70 70 81 15 2014 15 832 521 1,520 4 58 35 0 0 5 30 97 -10 -1,325 0 -1,324 0 -1 0 -78 -28 0 -21 -18 -11 -1,413 -1,316 -628 -1,316 1,617 204 -13 -13 -31 -44 160 1 1 ******** **** **555*1861 A 13.480 -12,870 2013 180 68 93 19 2013 832 509 1,521 43 28 0 0 28 72 * T F 4 -1,260 -1,259 -102 -1,376 -1,304 -615 -1,304 1,593 217 -31 -13 -19 -31 186 184 3 180 1 180 13,337 -12,708 629 -369 260 30 30 -16 274 -84 -84 190 -49 141 -150 -9 30 832 518 1,538 209 3 205 1 2012 188 66 210 7,127 -6,800 103 19 2012 327 -502 -1,255 0 -1,255 0 0 -175 486 486 -18 293 1 1 0 -102 -29 -92 0 -92 201 -18 183 -20 163 1 -1,374 -1,313 -607 -1,313 1,599 225 26 34 26 0 0 26 -14 -12 -2 61 -14 210 -18 0 -37 -21 -15

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

Patrick Busaka

I am a result oriented and motivated person with passion for challenges because they provide me an opportunity to grow professionally.

5.00+

38+ Reviews

58+ Question Solved

Related Book For

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe

Question Posted:

Students also viewed these Business questions

-

1. Based on the information provided in the case below, what is the key strategic goal for Tim Hortons as of August 2014? It would be a year of dramatic change for Tim Hortons Inc. On August 26,...

-

How would you rate the long-term solvency position of Montgomery Organizations plc between 2012 and 2015? Provide a brief report of the companys long-term solvency over time. Montgomery Organizations...

-

Liquidity How would you rate the liquidity position of Montgomery Organizations plc between 2012 and 2015? Provide a brief report of the companys liquidity over time. Montgomery Organizations plc,...

-

A tank of water of length 2 0 m , 1 0 m , and height 5 m is filled with water of density 1 . 2 g / cm 3 . Find the pressure ( in Pa ) of water on one of the walls at a point 5 9 cm above the bottom.

-

Isaac only has $690 today but needs $800 to buy a new laptop. How long will he have to wait to buy the laptop if he earns 5.4 percent compounded annually on his savings? a. 2.29 years b. 2.48 years...

-

( 1 point ) A manufacturing company incurs the fixed cost of $ 5 0 0 0 . The variable cost is $ 7 . 2 5 per unit produced. ( a ) Express the total cost as a function of the number n of units...

-

Event B: rolling a 10

-

Cash Equation Details Corp has a book net worth of $8,500. Long-term debt is $1,800. Net working capital, other than cash, is $2,380. Fixed assets are $6,400. How much cash does the company have? If...

-

please answer correct, otherwise skip it In Rhodesia Metal (Liquidator) v Taxes Commissioner (1940] the Privy Council held that the profits were derived from sources in: a. England b. Australia c....

-

What is the effective tax rate for Montgomery Organizations plc for each year? Montgomery Organizations plc, whose annual accounts are given below. The firm has 14,685,856 shares and the share price...

-

Rountree et al. (2008) show that investors do not like cash flow volatility. Consider the financial ratios presented in this chapter. Can you adapt an existing financial ratio or construct a new one...

-

How does an STL algorithm take a container as an output argument?

-

the assessment include developing gantt chart, work breakdown structure and and all task 3 are related to its respective task 2. all the instructions are given in the assignment itself. Assessment...

-

Mens heights are normally distributed with mean 68.6in. and standard deviation 2.8in. Air Force Pilots The U.S. Air Force required that pilots have heights between 64 in. and 77 in. Find the...

-

Swain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city....

-

ACC1810 - PRINCIPLES OF FINANCIAL ACCOUNTING Project 11: Chapter 11 - Stockholders' Equity Part B: Financial Statements The accounts of Rehearsal Corporation are listed along with their adjusted...

-

Match the term to the description. Outcome evaluation Focuses on the accomplishments and impact of a service, program, or policy and its effectiveness in attaining its outcomes set prior to...

-

Sodium benzoate, NaC7H5O2, is used as a preservative in foods. Consider a 50.0-mL sample of 0.250 M NaC7H5O2 being titrated by 0.200 M HBr. Calculate the pH of the solution: a. When no HBr has been...

-

Use a calculator to evaluate the expression. Round your result to the nearest thousandth. V (32 + #)

-

Residual Claims Clappers Clippers, Inc., is obligated to pay its creditors $6,100 during the year. a. What is the market value of the shareholders equity if assets have a market value of $6,700? b....

-

Marginal versus Average Tax Rates (Corporation Growth has $82,000 in taxable income, and Corporation Income has $8.200,000 in taxable income. a. What is the tax bill for each firm? b. Suppose both...

-

Net Income and OCF During 2007, Raines Umbrella Corp. had sales of $840,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $625,000, $120,000, and $130,000,...

-

Comfort Golf Products is considering whether to upgrade its equipment Managers are considering two options. Equipment manufactured by Stenback Inc. costs $1,000,000 and will last five years and have...

-

Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 71,000 shares of $10 par common stock. 8,500 shares of $60 par, 6 percent, noncumulative preferred stock. On...

-

Read the following case and then answer questions On 1 January 2016 a company purchased a machine at a cost of $3,000. Its useful life is estimated to be 10 years and then it has a residual value of...

Study smarter with the SolutionInn App