(Joint products; by-product) Indian River Mangoes runs a fruit-packing business in southern Florida. The firm buys mangoes...

Question:

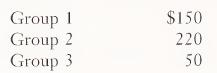

(Joint products; by-product) Indian River Mangoes runs a fruit-packing business in southern Florida. The firm buys mangoes by the truckload in season. The fruit is then separated into three categories according to its condition. Group 1 is suitable for selling as is to supermarket chains and specialty gift stores. Group 2 is suitable for slicing and bottling in light syrup to be sold to supermarkets. Group 3 is considered a by-product and is sold to another company that pro¬ cesses it into jelly. The firm has two producing departments: (1) Receiving and Separating; and (2) Slicing and Bottling. A particular truckload cost the company $1,500 and yielded 1,500 mangoes in Group 1, 2,000 mangoes in Group 2, and 500 mangoes in Group 3. The labor to separate the fruit into categories was $300, and the company uses a predetermined overhead application rate of 50 percent of direct labor cost. Only Group 2 has any significant additional processing cost, estimated at $220, but each group has boxing and delivery costs as follows:

The final sales revenue of Group 1 is $3,000, of Group 2 is $1,500, and of Group 3 is $450.

a. Determine the sum of the material, labor, and overhead costs associated with the joint process.

b. Allocate the total joint cost using the approximated net realizable value at split-off method, assuming that the by-product is recorded when realized and is shown as other income on the income statement.

c. Prepare the entries for parts a and b assuming that the by-product is sold for $450 and that all costs were incurred as estimated.

d. Allocate the total joint cost using the approximated net realizable value at split-off method, assuming that the by-product is recorded using the net realizable value approach and that the joint cost is reduced by the net real¬ izable value of the by-product.

e. Prepare the entries for parts a and

d, assuming that the estimated realizable value of the by-product is $400.LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney