Saccamano Company is currently manufacturing Part KAV-71, producing 35,000 units annually. The part is used in the

Question:

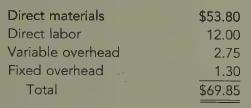

Saccamano Company is currently manufacturing Part KAV-71, producing 35,000 units annually. The part is used in the production of several products made by Saccamano. The cost per unit for KAV-71 is as follows:

Of the total fixed overhead assigned to KAV-71, $12,950 is direct fixed overhead (the annual lease cost of machinery used to manufacture Part KAV-71), and the remainder is common fixed overhead. An outside supplier has offered to sell the part to Saccamano for $64. There is no alternative use for the facilities currently used to produce the part. No significant non-unit-based overhead costs are incurred.

Required:

1. Should Saccamano Company make or buy Part KAV-71?

2. What is the maximum amount per unit that Saccamano would be willing to pay to an outside supplier?LO1

Step by Step Answer:

Introduction To Cost Accounting

ISBN: 9780538749633

1st International Edition

Authors: Don R. Hansen, Maryanne Mowen, Liming Guan, Mowen/Hansen